The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

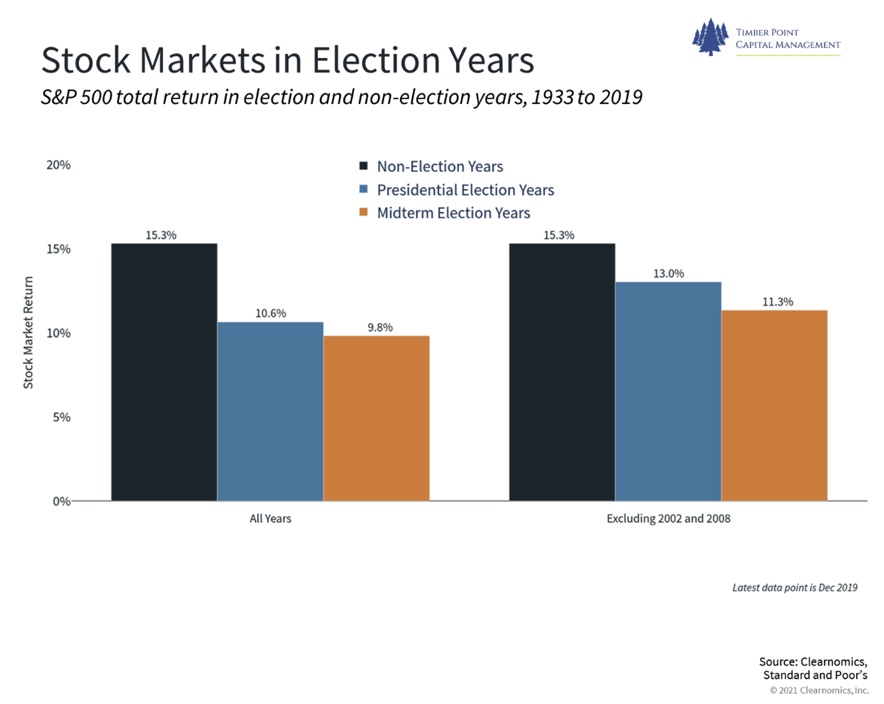

Local/State elections are important and can impact national policy direction

- VA going red and tight NJ race likely emboldens moderate Democrats

- Biden’s agenda was curtailed before election day, will need further trimming

- We still believe that some form of ONE infrastructure bill will pass

- State and local infrastructure spend has historically been higher than federal spend

- Biden administration making early noise on ramping regulatory measures on economy

- Market sniffed out election result as SPX 500 up 7% in October…split gov’t is ok!

- December legislative calendar will be heavy with debt ceiling, infra and budget votes

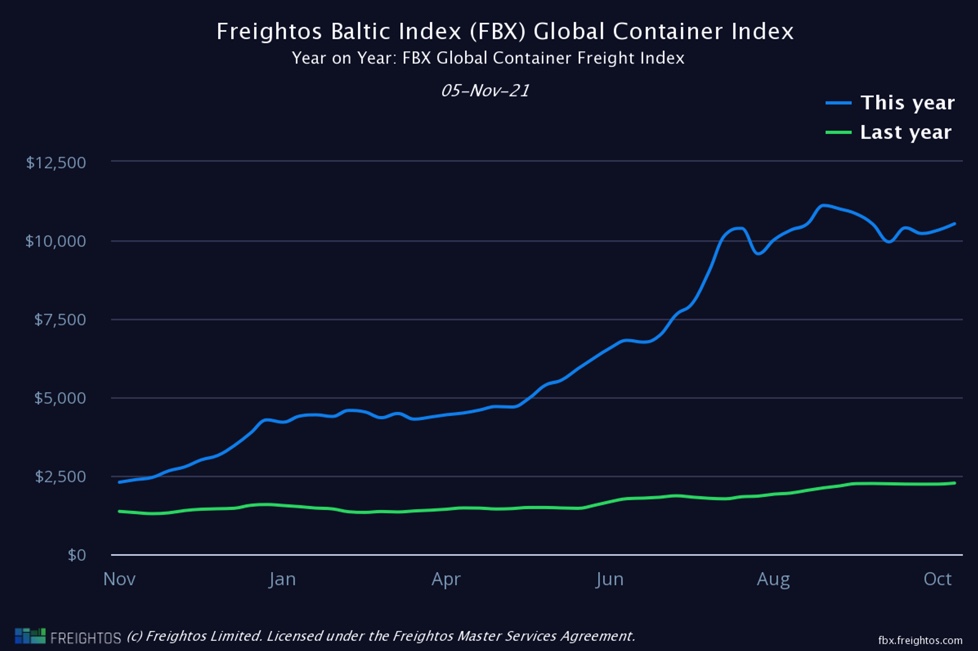

Supply chain concerns are well known, markets are self-correcting with time…

- Container prices have skyrocketed in 2021 (top chart) when compared to 2020

- Despite recent uptick, container prices are off Sept 2021 highs…is the XMAS rush over?

- Baltic Dry ETF down 45% since Sept peak…BDRY holds near dated futures on three bulk indices – Capesize (50%), Panamax (40%) and Supramax (10%)

- Dry bulk carriers transport unpackaged cargo = iron ore, coal, and grains…

- Both containers and dry bulk metrics may indicate supply chain concerns overdone

- Validates TPCM’s case on inflation? Once supply disruptions resolve, inflationary pressures should subside…see PCE level return to trend at 2% – 3%

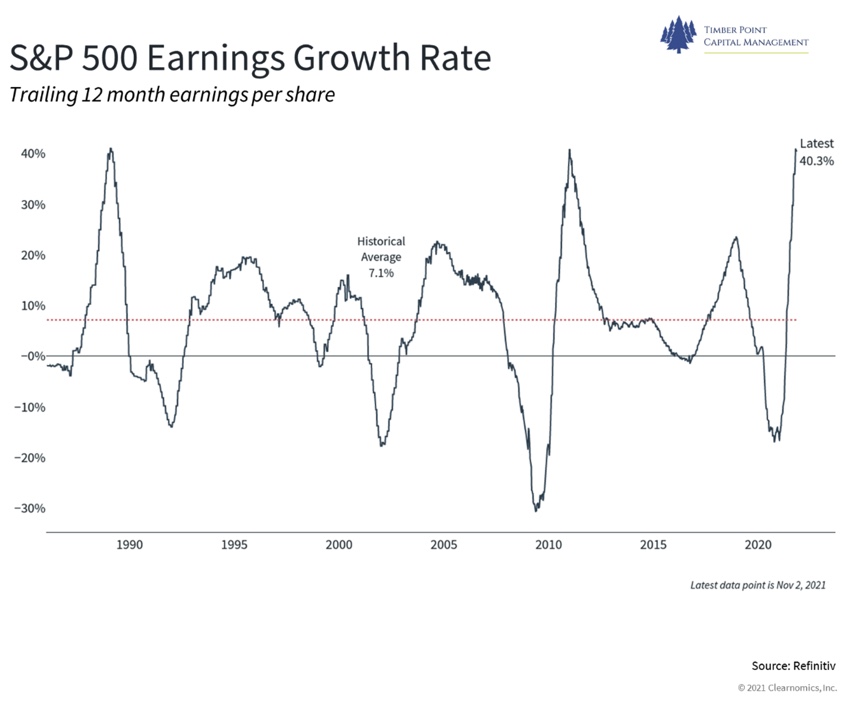

No surprise that earnings continue to surprise…

- 89% of SPX 500 companies have reported, 81% have beaten analyst estimates

- Over past 5 years, earnings beats have averaged 76% per quarter

- Revenues higher than estimate for 75% of companies; revs beating average est. by 3%

- Consensus SPX 500 earnings forecasts for ’22 have barely budged, now ~ $221, as companies issue cautious guidance

- If we assume that stock market should discount 20x P/E, implies eps of ~ $234 for ’22, or 6% upside to consensus estimates

- We still see GDP trend growth returning to ~ 2% over course of ’22…Goldman cuts GDP estimate to 4% from 4.4%…Conference Board at 3.8%…more cuts to come? Source: Factset

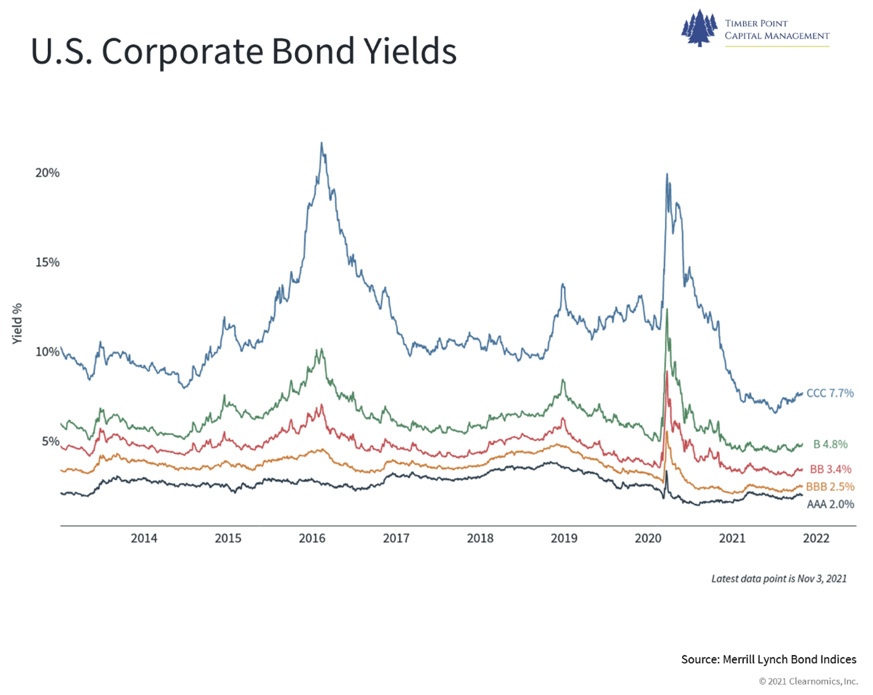

Bond market volatility rising as Fed prepares to pare back pandemic purchasing

- Asset values have been supported by aggressive monetary and fiscal policy

- Monetary policy now coming to end, fiscal policy more uncertain post election day

- Fed tapering to begin this month at $15 bln/month; rate hikes only when tapering over

- Have seen yields rise across the board; credit spreads wider but still historically “tight”

- Interest rates should move higher, offset by slowing GDP and resolving supply chain…

- Dislocation in labor market remains worrisome…supply issues result in price pressure

- US defaults on levered bank loans below ~3%….losses staggeringly low amongst banks

- Where do we see greatest risk? Private credit so much bigger than banking industry

- Apollo, KKR, other private capital players have seen massive growth in past few years

- Are insurance balance sheets safe? We see more risk here than others do

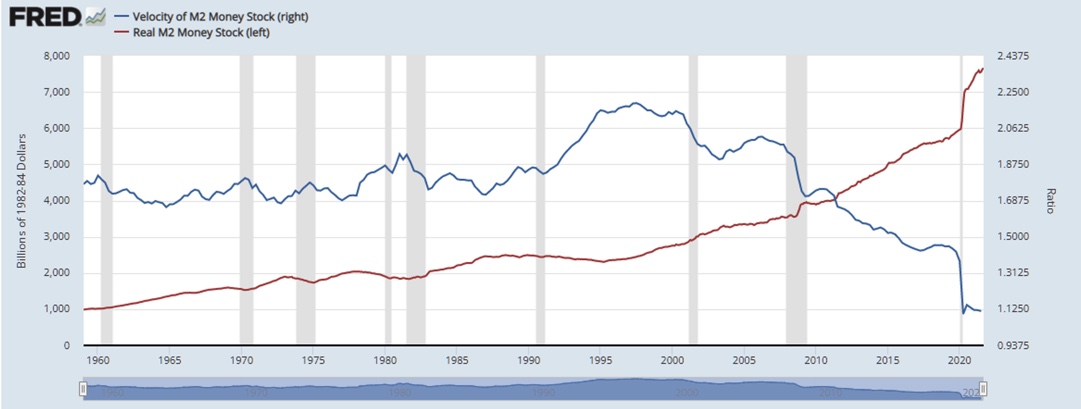

M2 Velocity remains low, shadow banking likely continues to accelerate

- M2 Velocity has been in multi-year decline and accelerated post GFC

- Driven by banks inability (replacing capital) or unwillingness (regulatory) to lend

- Growth in “shadow banking” industry has picked up that lending….looking for good measure of that to compare…

- “Shadow banking” operates free from regulatory scrutiny – think hedge funds, private equity, BDC’s and other private capital pools

- Our first “VicTalk” addresses our thoughts on inflation and supply chain…listen here

Recent Comments