The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Our take on the November Fed minutes published last week…

- Inflation – “With the effects of supply-demand imbalances in goods markets expected to unwind and labor and products markets expected to become less tight, the staff continue to project that inflation would decline markedly over the next two year; in 2025, both total and noncore PCE price inflation were expected to be 2 percent.” Magic 8 Ball says, “reply hazy, try again”…

- Consumer Inflation – “The trimmed mean measure of 12-month PCE price inflation constructed by the Federal Reserve Bank of Dallas was 4.7% in September.” October plateaus at Sept. level but still a cycle high, Jun ’80 was prior peak (8.7%)

- Inflation – “Participants noted that longer-term inflation expectations were an important influence on inflation’s behavior and stressed that the Committee’s ongoing monetary policy tightening would be essential for ensuring that these expectations remained well anchored.” Trying their best to hold the line on monetary policy tightness…

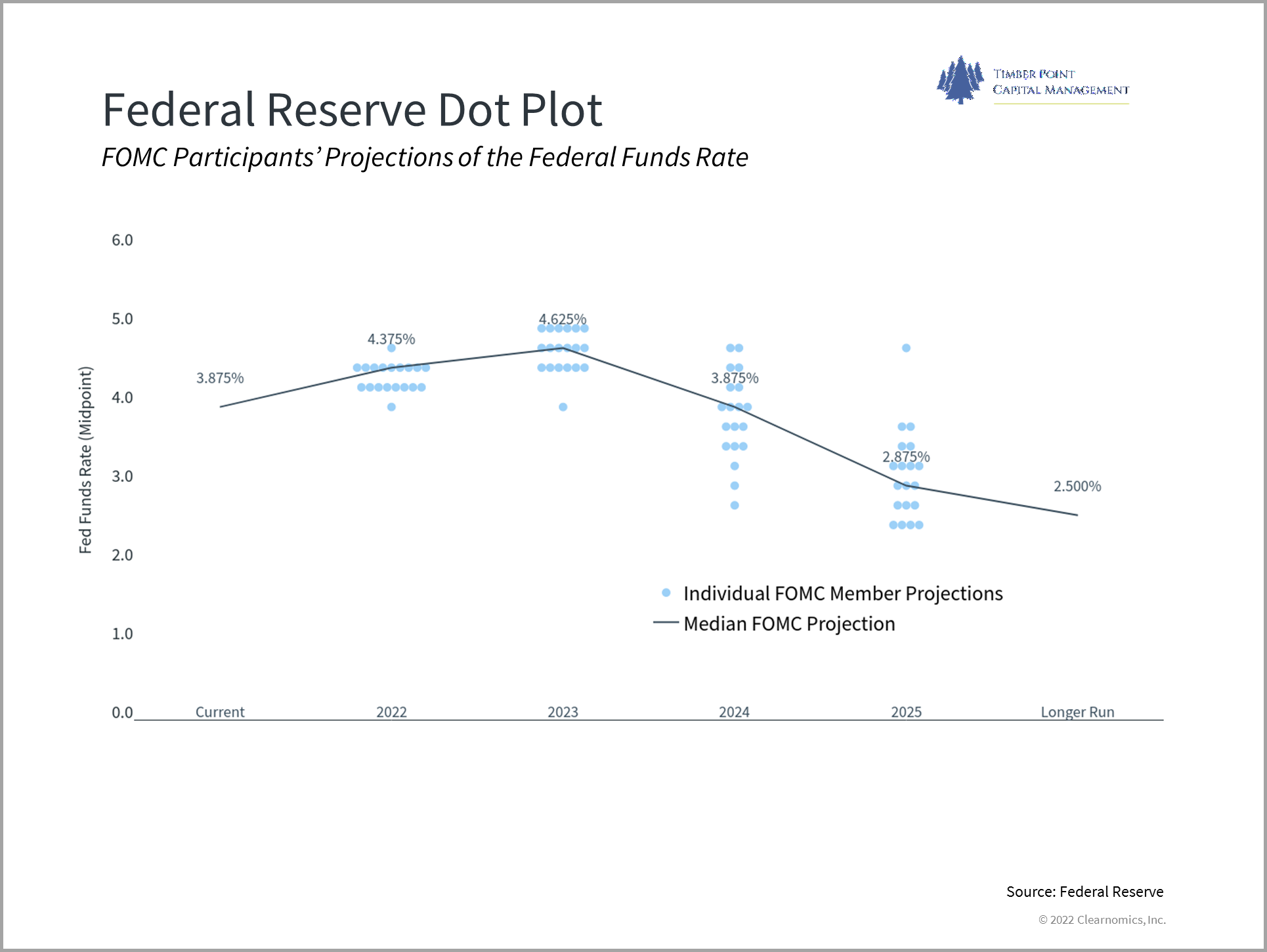

- Fed Funds – “…most respondents…viewed a 50 basis point increase in the target range for the federal funds rate at the December meeting as most likely…” Super-size rate hikes of 75 bps in the past…

- Treasury market – “In markets for U.S. Treasury securities, some measures of market-implied volatility approached pandemic-era levels.” Thank you, England…and Fed speak.

- Agency Securities – “Spreads of yields on agency mortgage-backed securities over yields on Treasury securities widened sharply…” Translation: housing market in the dumps…

- Labor Market – “conditions remain quite tight”; “nonfarm payroll employment posted a solid gain that was somewhat slower than the pace seen in recent months…” Tip of the iceberg for employment and thus the consumer…?

- Employment Cost Index (ECI) – “…three month change in the ECI in September was noticeably lower than the average pace seen over 1H22.” Encouraging…but real wage growth continues to be negative…

- International – “Data pointed to weakening foreign economic activity in recent months…” noting Russian invasion of Ukraine, headwinds in China and tighter financial conditions. U.S. is the port in the storm…

- International – “…fiscal authorities in Europe and Japan announced packages to intended to ease the burden of high inflation on consumers and business.” Japan rates stay anchored near zero…

- Credit in U.S. – “Credit quality remained sound overall, although there are some signs of deterioration for lower rated borrowers.” No real signs of credit stress yet…autos to be the first sign?

- Credit in U.S – “…banks…reported being less likely to approve auto and credit card loans to subprime and near-prime borrowers compared with earlier this year.” Slowing credit growth…

- Outlook – “Broad financial conditions were expected to be considerably more restrictive over the projection period than in September…” First rake hike was in March, waiting on lag effect…

- Outlook – “..the risks to the baseline projection for real activity were skewed to the downside and viewed the possibility that the economy would enter a recession sometime over the next year as almost as likely as the baseline.” 50/50 recession odds…

- Lag effect of monetary policy – “even though the tightening of monetary policy had clearly influenced financial conditions and had had notable effects in some interest rate sensitive sectors, the timing of the effects on overall economic activity, the labor market, and inflation was still quite uncertain, with the full extent of the effects yet to be realized.” More lag effect…

- Conclusion – “There was wide agreement that heightened uncertainty regarding the outlooks for both inflation and real activity underscored the importance of taking into account the cumulative tightening of monetary policy, the lags with which monetary policy affected economic activity and inflation, and economic and financial developments.” Fed hikes are closer to the end, Fed may soon pause…a pivot only if the economy goes into tailspin…

Fixed Income market rallies on “benign” inflation data…

- Recent Fed minutes note that longer term inflation expectations continued to be “anchored”

- October CPI report (+ 7.7% y/y) lifts fixed income markets – 10 year yield from 4.20% to 3.75%

- Investors expecting Fed to pivot in near term will be disappointed, more hikes to come

- Bullard does his best jawboning with “5% to 7%” fed funds rate…can the economy withstand?

- Fed becomes more data dependent to fine tune rate hike amounts…this is not a pivot

- Fed success on slowing interest rate sensitive areas of economy – housing, financial markets

- Employment figures confound expectations of slowing…service industries continue rebound

- Money supply growth is now negative – good for inflation, economic growth headwind

- Consumer chugs along, according to recent retail sales (+1.5% y/y)…how much longer?

- Being a big tech employee is not what it used to be…average salary at Twitter WAS $240K

- Peak yields? Economic challenges to the economy are clear…when does the consumer pull back?

- Inversion concerns are front and center especially after recent rally…not a sure fire recession predictor but pretty solid…

- Yet, high yield bonds outperforming high grade by large margin over past quarter is not indicative of an impending recession…

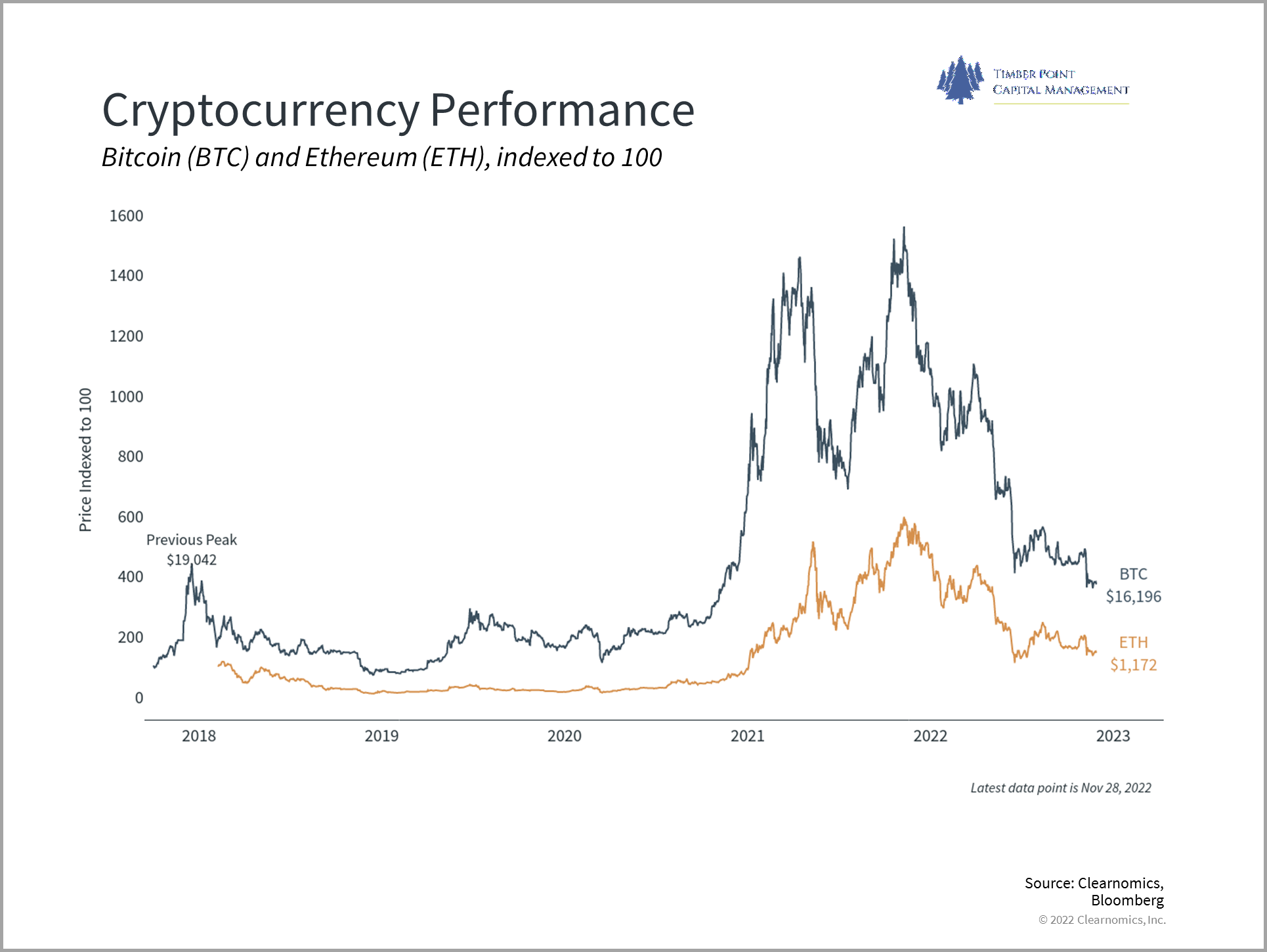

Crypto/FTX collapse…it is hard to look away…a cautionary tale

- Truth be told, we never fully understood the investment equation for crypto currencies

- As multi-asset managers, we challenged ourselves to understand it…we tried, we largely failed

- Perhaps it was a generational thing, maybe we just aren’t that smart or are too cautious

- In our mind, there were too many tokens, the latter ones created largely to enrich founders with little to no way to determine a true value

- Crypto is not a cash or currency nor legal tender…

- When money was free and plentiful, speculation rampant and people cooped up by a pandemic this led to incredible price spikes, supply excess and the birth of bad actors

- That said, we never expected to see a large player like FTX laid out in less than a few days

- Legitimacy came from the players involved (Sequoia, etc.) and the huge sums of money raised – the latter a red flag…

- Ability to move customer assets to affiliated firm, Alameda Research, allowed them to stave off earlier currency runs on existing positions and feign strength…at expense of investors/depositors

- End of the day, with very little in liquid assets an old fashioned bank raid did FTX in…old story in new space

- Would regulation have helped? Walling off investor money would have been a good thing…most should have known that they had no government backing and were likely an unsecured creditor in the event of exchange/custodian liquidation

- but bad actors will find a way to fleece unwitting investors

- We will continue to study the major crypto currencies, perhaps this is merely a VERY LARGE blemish on an otherwise promising new asset class

- To paraphrase Einstein, until we can explain it simply we wont be comfortable that we understand it fully…

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments