The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin.

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Political activity coming to a head, will the Dem’s get what they want?

- Calendar becoming the enemy of Dem’s – mid-term election focus sharpening

- Republicans have provided Dem’s with some cover by extending debt limit

- Infrastructure plan still very partisan; CBO scoring not supportive of passage

- Biden to meet with Manchin; Manchin has leverage with inflation reality/numbers

- There are others in Dem party that are concerned with passage of bill

- See Victor Canto’s thoughts on the Build Back Better plan – we are not fans!

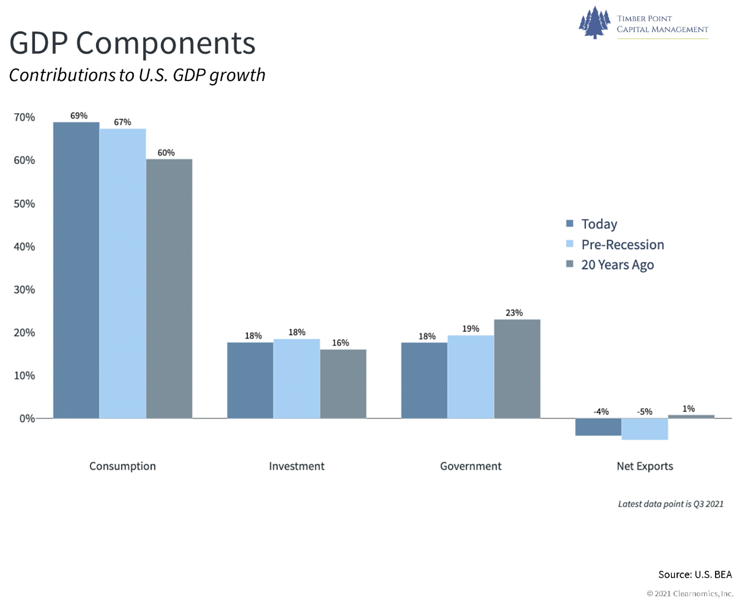

- Government share of GDP growth increasing; Covid impacting consumption #’s

- 15% minimum global tax best seen as govt’s colluding to stymie competition

- Covid may have enabled a resurgence of regulators to interfere where they shouldn’t

Fed turns hawkish with accelerated tapering and ’22 rate hikes…

- Inflation increases are NOT transitory according to Powell, now taking action

- Are inflation fears peaking? Wouldn’t that be ironic, we think they could be…

- TLT (20 Yr) made a new 2021 high last week; 30 Year is up 9% since April

- TPCM believes economy is slowing and inflation will subside

- Supply chains will normalize; corrective action to result in overcapacity? Likely…

- FRED now has 30 new inflation charts – is that another sign of a top?

- But FRED is still not updating excess reserves chart that TPCM likes to follow

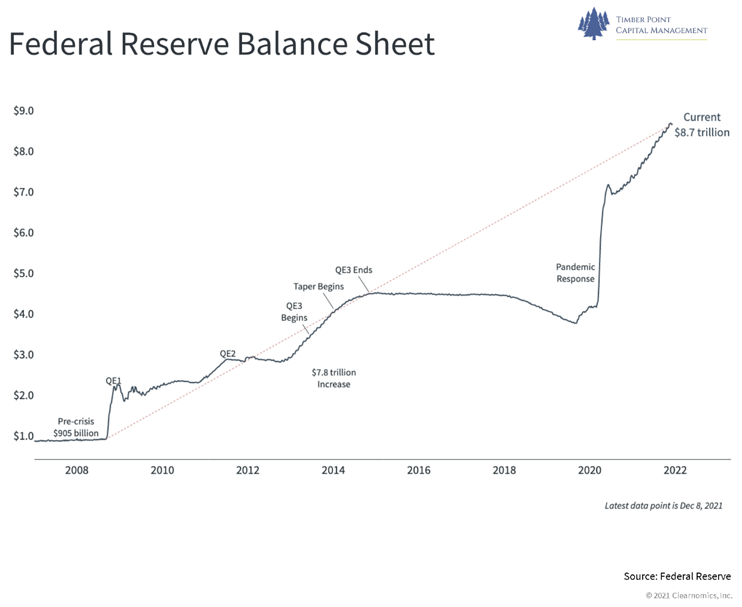

The Federal Reserve has no playbook for reducing its balance sheet…

- The Fed has no precedent for reducing its balance sheet…

- Monetary expansion after GFC was more of a roll off, very limited reduction

- At post GFC rate, would have taken 50-100 years to reduce to pre-GFC level

- Balance sheet expanded again in 2013 – 2015 period, often forgotten

- Remember the Taper Tantrum in late 2018 as the economy slowed…

- Fed would like wiggle room to expand yet again if another crisis occurs

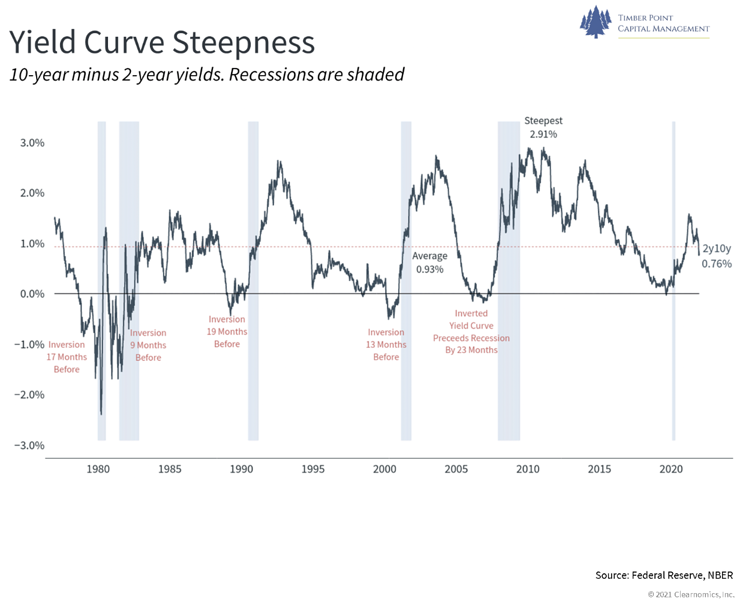

- We don’t expect aggressive balance sheet reduction; with Fed fund rate hikes expect the yield curve to flatten

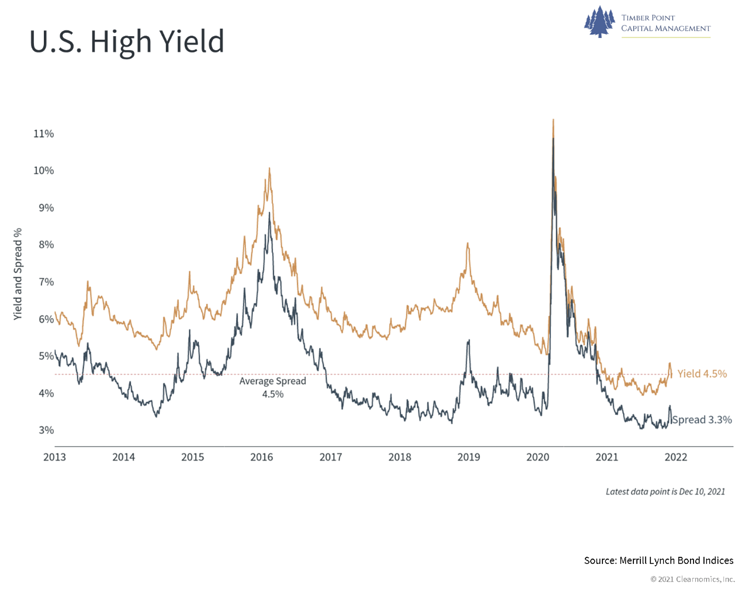

Credit not showing signs of stress…

- High yield performed well during recent market sell-off, very little panic

- High yields spreads are contracting again after recent widenings

- Watching spreads carefully, gives confidence that equity market is still

- Liquidity starting to leave credit market as approach year end

- Credit fundamentals improving is the belief….does this make sense?

- We worry about office real estate and retail – gov’t subsidies have supported

- WFH continues will prompt decisions on lease and rent expense

- Could result in higher vacancies next year; how long until it impacts cap rates??

- New issuance heavy this week in investment grade & high yield but then tapers

Random investment thoughts to consider…

- KRBN is interesting = Carbon Credit ETF…may become a new asset class

- Gov’t mandates are the driver of carbon credits, especially out of Europe…

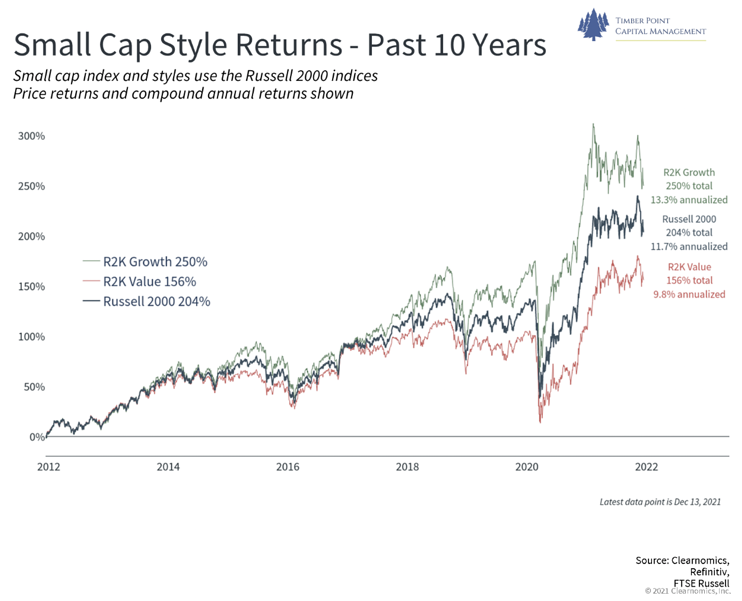

- Domestic Small cap concerns – supply chain is an issue as last in line for goods

- Higher wages an issue also – will smaller companies in rural areas have to pay urban union wages? If so, will hurt their competitiveness

- Airlines/Travel – old Covid playbook was dusted off for Omicron…unless we get significantly worse news on Omicron, we believe it presents an opportunity

Recent Comments