The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

The consumer is “alive and well”…let’s take a bit deeper look…

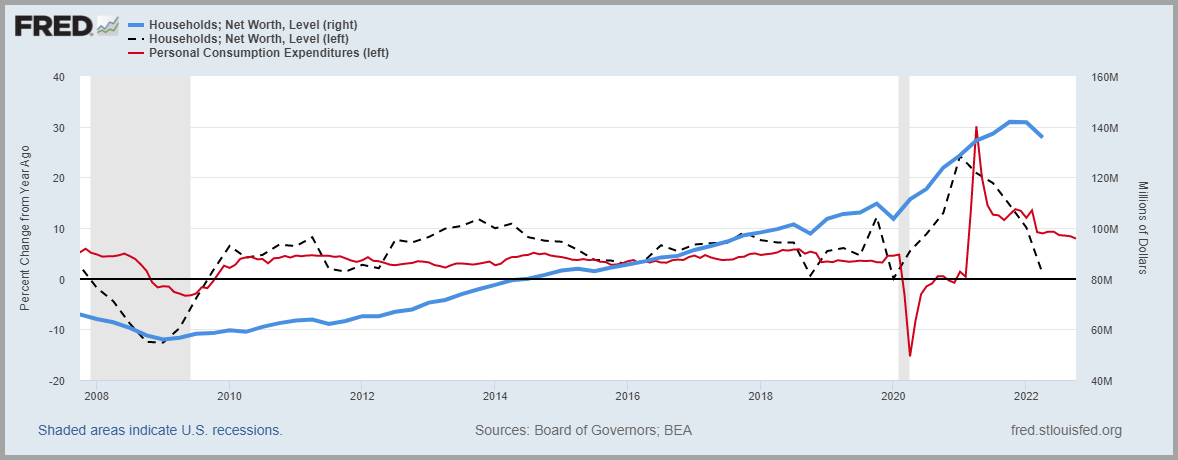

- Y/Y growth in US Personal Consumption Expenditures (PCE, top chart, red line) remained solid in October, up 7.9%, in line with estimates…

- PCE y/y growth is still elevated relative to prior decade taking out extremes of past few years

- Strength was fueled by service growth, up 8.2% y/y, while goods were up 7%

- No doubt the consumer continues to spend…but what is their capacity to continue to spend in the future in what could be a weakening economy?

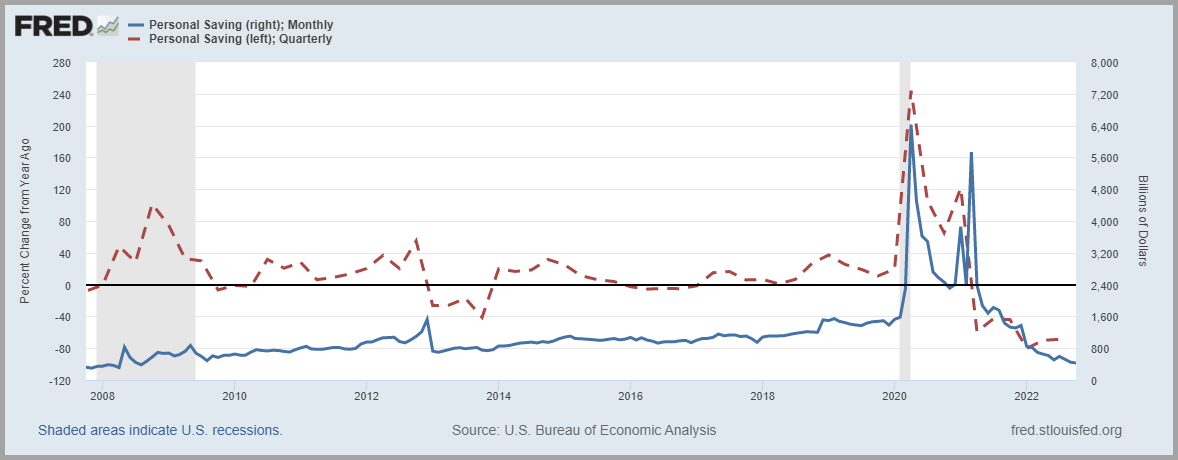

- We looked at aggregate Personal Savings (top chart, blue line) which has declined substantially from the Covid-19 pandemic government largesse

- In fact, Personal Savings are now well below pre-pandemic levels and back to 2008 levels…this is quite a drawdown

- We also looked at Household Net Worth (HNW, bottom chart, blue line)…data is through 2Q22 but this figure has begun to rollover, albeit from record levels

- Y/Y growth in HNW (black dash) is now flat with year ago levels, and will likely go negative when 3Q22 data arrives

- Last negative HNW y/y figures were in GFC which saw a 20% decline from 3Q07 to 1Q09…

- Consumers likely aren’t dipping into investment portfolios or real estate holdings to support consumption…declines in HNW likely do restrict spending impulses

- Can consumers add more debt? Consumer loans have spiked since mid ’21, and are well above pre-pandemic levels

- However, when viewed as % of Disposable Personal Income this debt looks manageable…

- Disposable Personal Income continues to grow at trendline levels of low single digits…

- Obviously, continued strong employment trends bode well for the consumer…and needs to continue

- No alarm bells right now but “alive and well” bears watching with the consumer responsible for 2/3 of the economy…

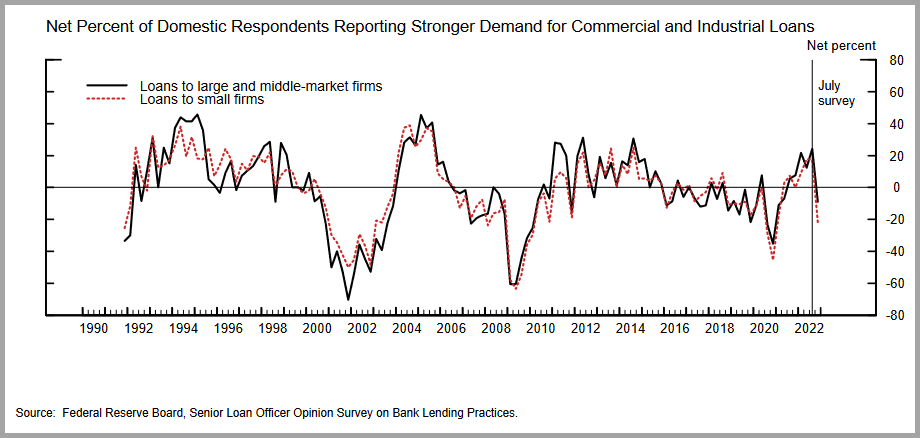

What is going on with bank lending? We checked in with “SLOOS”…

- SLOOS is the acronym for the Senior Loan Officer Opinion Survey which is a monthly survey conducted by the Federal Reserve and mentioned a number of times in its November minutes…worth a look

- Respondents include 71 domestic banks and 18 U.S. branches and agencies of foreign banks

- SLOOS addresses changes in the standards and terms, and demand for, bank loans to businesses and household over the past three months (3Q22)

- For Commercial and Industrial (C&I) loans: banks noted an increase in standards on loans to firms of all sizes in the form of higher premiums charged for riskier loans, cost of credit lines and increased spread of loan rates over cost of funds

- A “significant” share of banks reported tighter loan covenants on C&I loans to large and middle market firms

- Demand for C&I loans was characterized as weak from smaller companies with medium and larger companies posting demand fairly consistent with prior months

- A decreased need to finance inventory and less investment in P&E were given as drivers for weaker demand

- For Commercial Real Estate (CRE) loans: a “major” share of banks reported having tightened standards for construction/land development loans…a “significant” share reported tighter lending standards for multi-family properties

- Weaker demand for all CRE loan categories was mentioned by a “significant” share of banks

- Re: residential real estate lending, a “moderate” share of banks tightened standards for subprime residential mortgages and HELOC’s

- No surprise, a “major” share of banks reported weaker demand for all residential RE loans

- Credit card/other consumer loans reported tighter lending standards, with auto loans remaining unchanged

- Demand for credit/other consumer loans was reported to be stronger by a “moderate” number of banks, demand for auto loans was reported as weaker by a “significant” number of banks

- A “significant” number of banks reported they were less likely to approve credit and auto loans for borrowers with FICO scores of 620 or less.

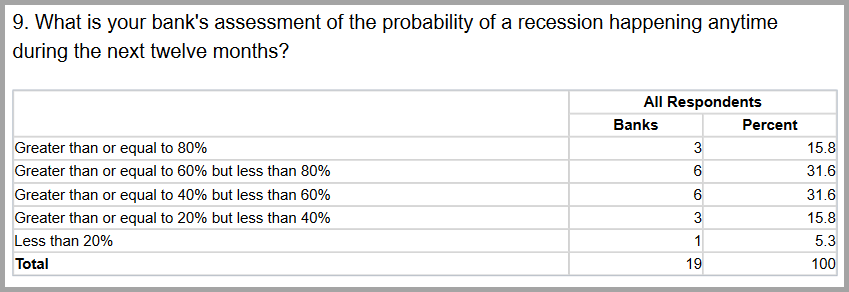

- In a special question, banks were asked about the likelihood of a recession in the next 12 months…Most banks assigned probabilities between 40% and 80% (chart above)

- Most commented that they expected the recession to be mild to moderate…

Source: Factset

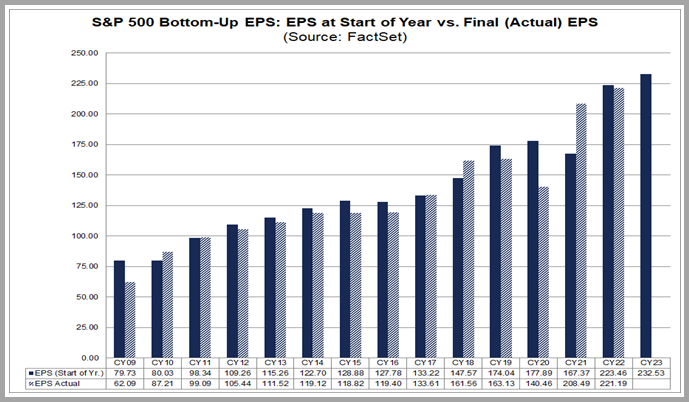

Recession Watch…what recent history tell us about earnings revisions

- Recession alarm bells are ringing from inverted yield curves to leading economic indicators

- We have our concerns as well…primarily around the continued strength of the consumer (above note)

- However, IF we are heading into recession, a recent note by Factset can provide a bit of context on what to expect from earnings

- Using Factset data, the current 2023 SPX 500 earnings estimate is $232, a peak going back to 1996

- This compares to 2022 SPX 500 earnings estimates of ~ $221, a ~5% estimated eps growth rate for 2023

- Over the 25-year time span, one year forward earnings estimates vs. actual year end estimates have differed, on average, by 7%

- 68% of the time, analysts have overestimated one year forward estimates…optimism abounds, no surprise there

- Only 3 times in the last 15 years have analysts underestimated actual earnings – 2011 (9%), 2018 (10%) and 2021 (25%)

- In 4 of the past 25 years, analysts have overestimated actual earnings by greater than 25%…!

- What do those 4 years – 2001 (+36%), 2008 (+43%), 2009 (+28%) and 2020 (+27%) – all have in common? Yes, all recession years…

- Granted, these years had some pretty severe unforeseen events during those timeframes: 9/11, GFC and the Covid-19 pandemic

- So, we can cut the data a few different ways…an “average” 7% overestimate of earnings would result in SPX 500 earnings of 205 in 2023

- If we believe that 2023 could be an outlier year and a 25% decline is in the offing, 2023 actual earnings could be as low as $165…which is essentially back to pre-Covid earnings levels (2019)

- Take your pick…or somewhere in between…assuming a market multiple of 17x, implies an SPX 500 target of 2800 – 3400…

- Or, perhaps analyst estimates of $232 will prove to be correct…in which case a 17x multiple implies SPX 500 of 3944…pretty close to current levels…

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments