The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin.The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

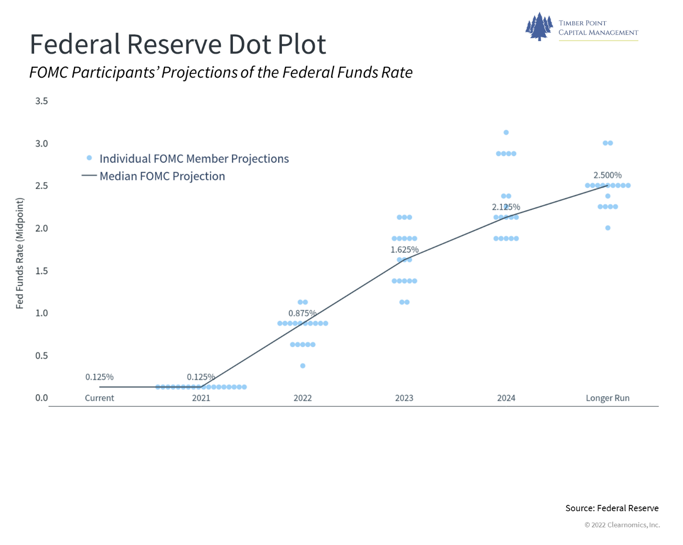

It’s time for the Federal Reserve’s next move – Powell will be “nimble”…

- Powell cites need to be “nimble” – what exactly that means Powell doesn’t spell out

- Market interpretation has been to discount far faster rate hikes than just 4 weeks ago

- Whereas most thought 2 or 3 rate hikes in ’22 just weeks ago, now even odds on 5 rate hikes

- Uncertain guidance on balance sheet reduction, will rate hikes end before starting

- Fed repeats 2% inflation goal, while noting economic strength and strong employment

- Rate hike hysteria driving the market, though 10-year bond has recovered from January lows

- Credit spreads remain subdued – yes, high yield rates ticked up, as have 2 and 5-year yields

- Consider: GDP print of 6.9% driven by inventory replenishment…will that continue?

- Consider: China zero-Covid policy has interrupted supply chains – continue post Olympics?

- Any hint of slowing economic growth could unwind Fed rate hike expectations quickly…

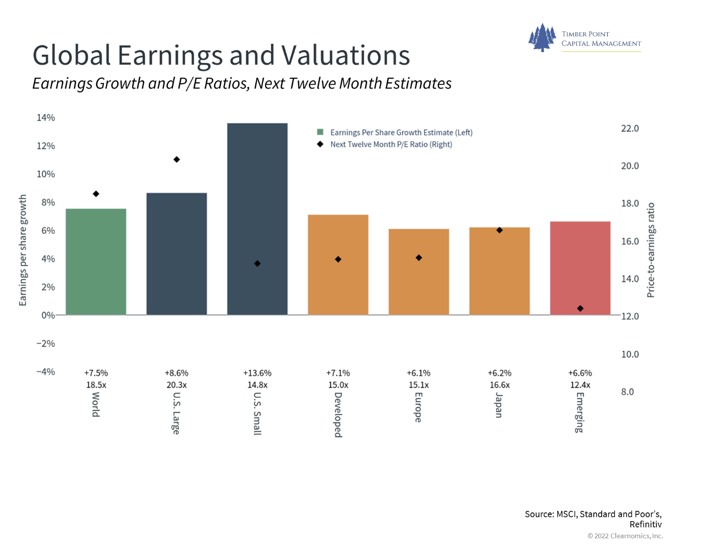

Earnings surprises continue at rapid pace, will the equity market care?

- Roughly 1/3 of SPX 500 have reported earnings thus far – 81% beat estimates by average 4.7%

- Strongest eps beats coming from Energy (31%), Consumer Disc (27%) and Technology (8.6%)

- Negative eps surprises from the Industrials (-20%) and Basic Materials (-3.5%)

- 74% of SPX 500 beat on top line by average of 2.8%

- SPX down 5.2% in January, Nasdaq down 9%…sentiment measures wildly oversold, rally ensues

- Market focused on inflation clarity which will determine Fed hikes and yield curve

- Covid concerns are easing, could help supply chain and labor concerns

- Mid-term elections may prove to be more “business-friendly” for US companies or at least lessen risk around legislative miscues

- OUS, EM markets (Brazil, Chile, Peru) have been strong – oil, commodity related most likely

- China market apparently stabilizing, positive commentary over the weekend from officials

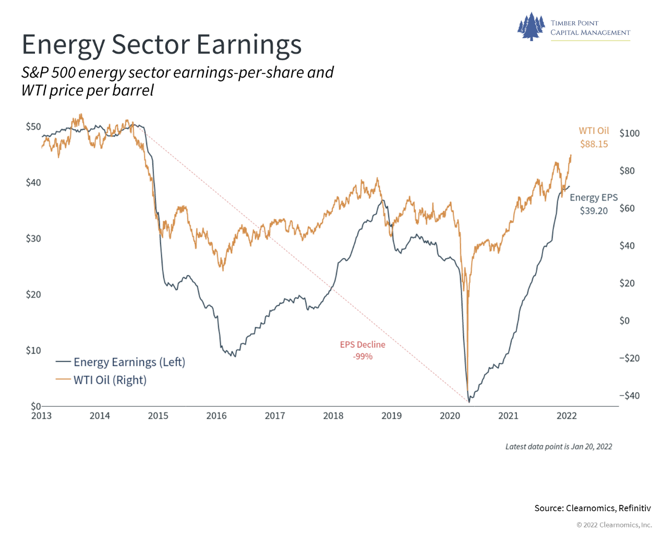

Energy markets leading sector returns again in ‘22…more gains ahead?

- Energy sector only positive return YTD in SPX 500, up 19%…Energy sector up 69% over TTM

- Drivers = geopolitical risk (Russia), supply discipline (Saudi/US), tight spare capacity

- US volumes not back to pre-pandemic levels of 13M bbls/d, now at 11.6M bbls/d

- US producer capex restrained by regulations and investors desire for cash return

- Good for large oil, many trade well above 200 dma – look at XOM, CVX, MPC and COP

- Oil service companies starting to break out…market caps are small, should we care? Yes.

- The two largest, HAL and SLB, both breaking thru 200 dma; smaller names still < 200 dma

- HAL 4Q21: “accelerating upcycle”, “improving service pricing”; revenue up 11% and operating earnings up 20% sequentially

- SLB 4Q21: “growth accelerated”, “supporting further pricing”; “substantial step up in capital spending amid tight capacity”; revs up 6% sequentially, 6th straight qtr of margin expansion

- Rig count in US at 481, down 30% vs pre-pandemic levels; Int’l rig count 834 vs. 1059…

Recent Comments