The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Goodbye, QE II – It Was Nice Knowing You…

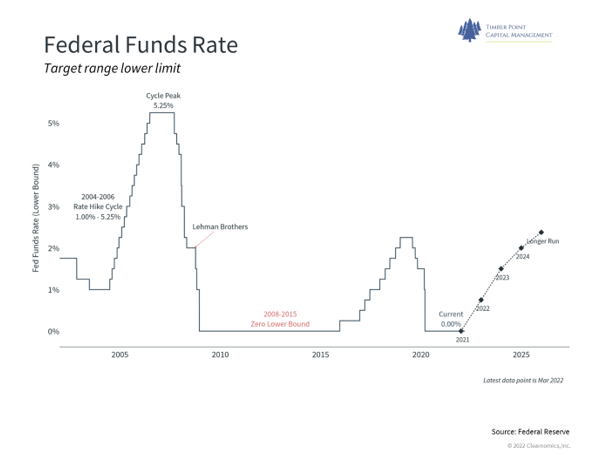

- Fed meeting on Wednesday will begin rate hike cycle…Powell stated 25bps to start

- Fed expansion of balance sheet is over…$40bln of Treasuries, $20 bln of MBS each month

- Timing of balance sheet reduction is uncertain, will wait for a few rate hikes to assess impact

- Fed preference to return to Treasury holdings and housing strong = MBS is first to go…

- Fed has no playbook for balance sheet reduction – will depend on GDP impact, outside events

- 2018 balance sheet reduction was minimal; 2022 will start with run-off vs. sales, duration?

- Fed is in a box – with highest CPI print since early ‘80’s, action needed for credibility

- Ukraine/Russia likely to exacerbate inflation prints going forward – energy and food prices

- Given current backdrop, monetary policy mistakes are easily compounded

- Fed mandate includes full employment…unemployment and GDP growth cooperate…for now!

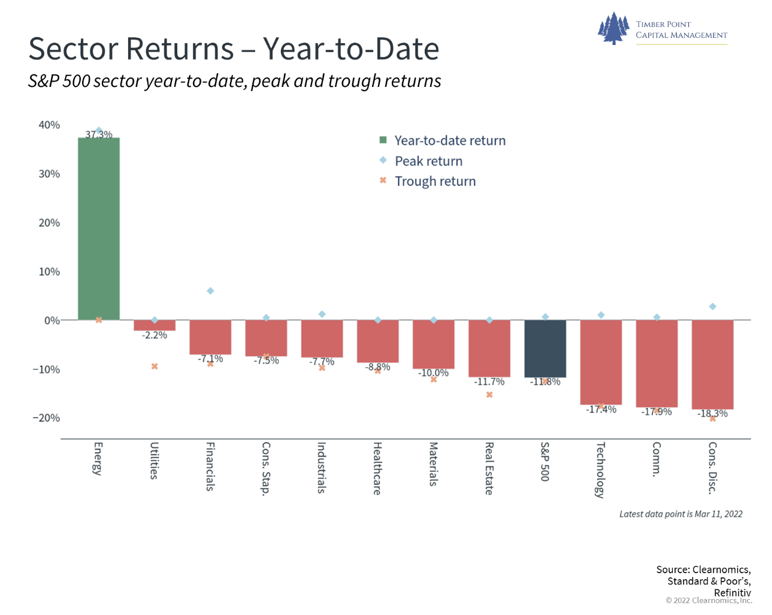

From Investment Pariah to Top Pick…Energy sector returns lead the way

- Energy sector only positive return YTD…spread between tech and energy largest ever

- Biden admin will look everywhere for oil – Saudi Arabia and Venezuela – before the US

- Oil investment and production ramps require policy and long-term perspective

- “Carbon free” is a multi-decade transition, needs to be managed with skill and common sense

- Oil, natural gas, coal, nuclear provide 88% of US energy needs…this is a transition!

- Biomass is the largest renewable source at 5%; Hydro 3%, Wind 3%, Solar 1.5%

- Financial markets will react to price signals much faster than physical markets

- Energy companies resisting growth, focused on total return – dividend and stock buyback

- Global oil demand in 2022 will top pre-pandemic demand…100 mln bbls/d needed

- BP, RD/Shell and XOM pulling out of Russia – how does that impact Russia production capacity?

- Surplus capacity resides with Saudi Arabia…Saudi/OPEC not signaling willingness to add volumes

- Saudi hates US shale suppliers who it sees as swing producer – remember 2014/2015

- Extreme backwardation in crude oil futures market, long term prices up but not near spot levels

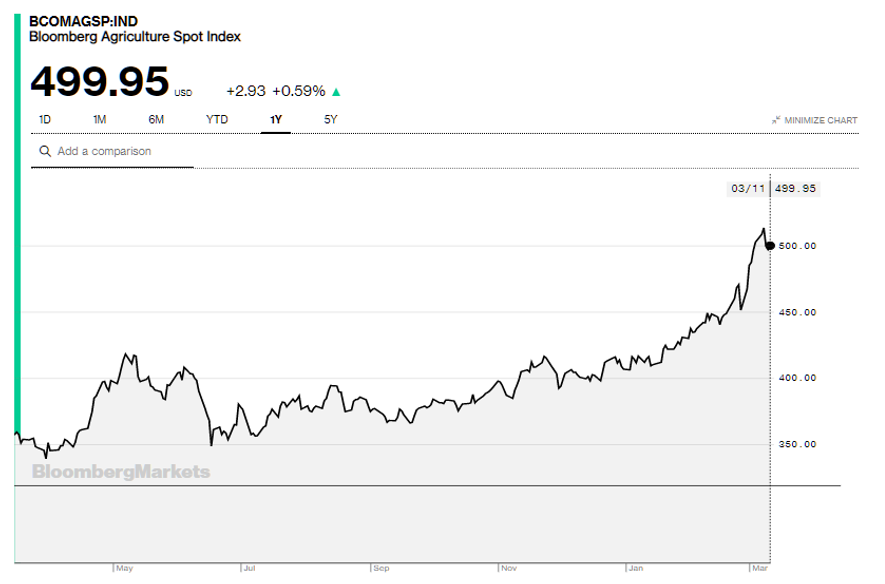

Commodities: Not Just Crude Having Their Day in the Sun…

- XME up 28% YTD…ESG, regulatory concerns, NIMBY impact investment levels

- Thermal and met coal producers are 20% of index – BTU, ARCH and AMR up 50% – 100% YTD

- Steel and specialty metals another 20% of index – AA, ATI, CENX and X all up > 50%

- Agricultural commodities impacted by Ukraine/Russia – WEAT, CORN, SOYB moving higher

- Russian fertilizer inputs higher: produces 9%/10%/20% of nitrogen/phosphate/potash fertilizers

- EV inputs – nickel, cobalt, lithium hydroxide all up big – margin pressure likely, ASP hikes?

- Nickel prices up the limit, still not trading for days after big “hedging” exposure surfaces

- EV inputs largely controlled by non-friendly countries; local efforts stymied by ESG and NIMBY

- Q1 earnings commentary will be interesting: can pricing actions offset input cost hikes…

Stock Market Has Caught a Cold, Very Few Places to Hide….

- Economy still re-opening again after C-19, investors focused on cash flow, stability over growth

- China derisking continues…fund managers head for the exits to avoid the “next Russia”

- AAPL is the last of the FAANG’s still trading above its 200 dma…can it hold?

- XLE, XLU are the only Sector SPDR ETF’s trading above 200 dma…XLP (staples) just dipped below

- Industry SPDR ETF’s above 200 dma are XOP, XES, KRE, XAR, XME ; KBE trying to hang on

- XPH (Pharma) and XHS (Hcare Services) Industry SPDR ETF’s just regained their 50 dma

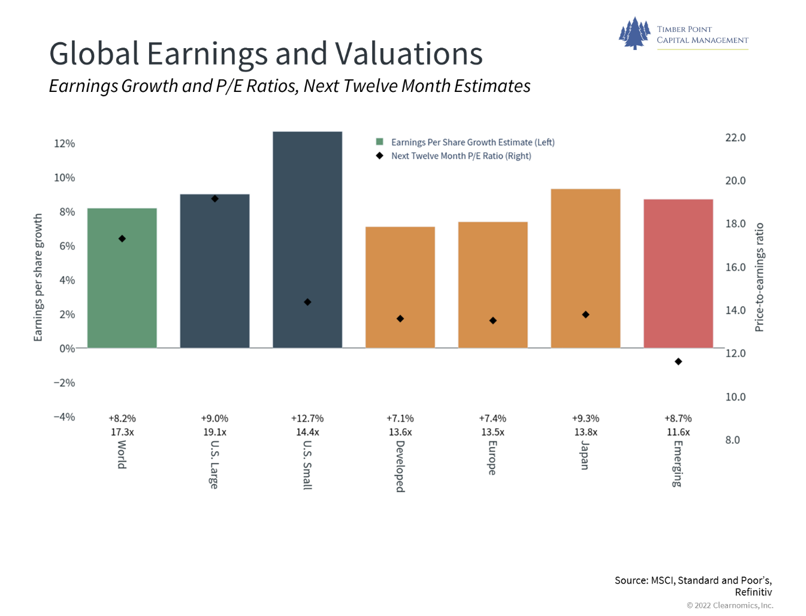

- Value over Growth continues, Equal Wtd over Cap Wtd, Int’l slight favor over domestic (US)

Politics As Usual – Biden still wants Build Back Better

- President approval ratings, mid-term elections will have a meaningful impact

- Low Biden approval rating means mid-terms likely results in Republican sweep of Congress

- House and Senate adds will give Republican’s control of Congress, but Biden has veto power

- We do not see Biden “pivot” to bi-partisanship as realistic – SOTU speech was rebranded BBB

- Clinton pivot to centrist policy is the model; Obama won reelection without moving to center

- Incentive structure is what the Progressive’s do not understand…are too focused on equity

- Response to Russia has been incremental and thoughtful – NATO unity is surprise outcome!

- If Russia succeeds, why would any country give up nuclear arsenal? Japan now considering!

- Global condemnation and financial repercussions for Russia aggression vs. Ukraine

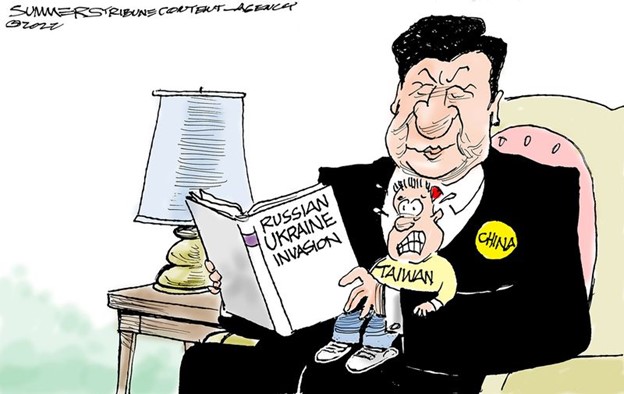

- China attack on Taiwan will need to consider exile from global financial and trade system

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’ and IPIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments