The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

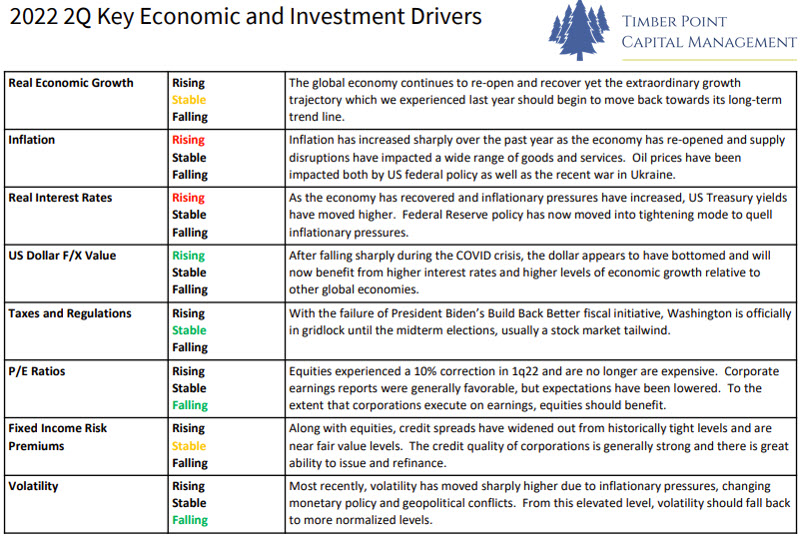

Turning the corner into 2Q22…what is TPCM’s viewpoint?

- Re-opening will benefit the economy but economic growth is reverting to trendline of 2%

- We are not expecting a recession…we believe Fed will back off rate hikes with weak data

- Inflation is everywhere as a function of monetary policy, supply chain dislocations, Ukraine

- Slower economic growth and supply chain recovery improve inflation figures in medium-term

- Real interest rates still remain negative as rate hikes and long end not offset inflation prints

- Fed rate hikes will result in difficult FI market for most of year – we look for trading oppty’s

- The US $ is best house on the street…OPEC/China want to move away but impact is negligible

- Strong-ish $ represents a headway for Int’l and EM, we still prefer domestic equity

- Taxes/regulations are stable but have increased over past year…this is a negative for US markets

- Valuations not expensive, nor are they cheap – don’t expect bullish guides from 1Q22 reports

- We believe that fundamental credit quality remains solid and is not a meaningful risk factor

- We see volatility falling from elevated levels as market is in process of digesting slower growth, slower inflation improvement and geopolitical issues

Fixed Income – the “safe” asset class…

- Equities have corrected while the bond market has had a “crash” relative to history (see chart)

- Nominal treasury yields remain lower than anticipated inflation resulting in negative real yields

- Real yields will need to move higher – via inflation moderation or higher rates, or a combo

- Credit spreads have widened but not reflect excessively risky environment for corporate issuers

- Increase in the absolute yields of corporate credit could possibly constrain issuance

- Fed tightening will continue to flatten the curve which is a risk for the economy and equities

- Bond investors will continue to be challenged to find ways to earn positive rates of return in an environment of high inflation and a tightening Fed

Stock buybacks are on the rise…debt levels as % of net worth are steady

- Declining stock prices and still robust corporate cash flows result in surging buybacks

- Mgmt’s taking a page from prior stock market downturns to signal confidence in outlook

- Also used as way to manage earnings in difficult environment by reducing shares count

- As tax rates head higher, stock buybacks are a more tax-effective way to return earnings

- Non-financial corporate debt has doubled over past 10 years…but flat as % of net worth

- SEC proposes increased buyback disclosure rules to “lessen the information asymmetries”

- Biden wants a defined moratorium on executive stock sales while repurchases are in effect

Chart courtesy of Yardeni Research

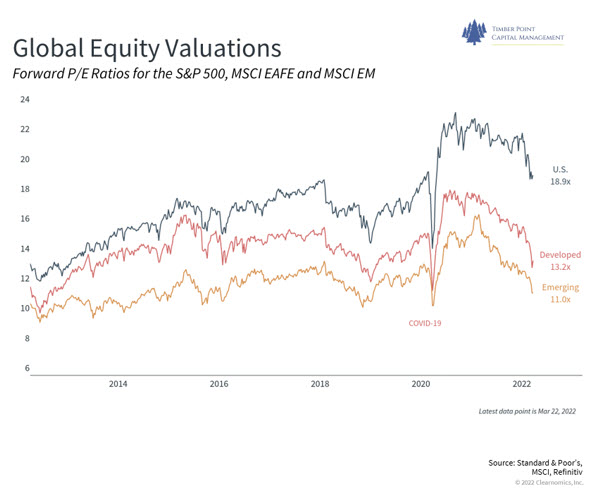

Global valuations have declined but still not cheap relative to history

- Post Covid-19 earnings recovery, forward P/E multiples in US traded above historical levels

- Developed and EM forward P/E multiples were more in line with historical levels

- Unprecedented US monetary policy response to Covid-19 fueled risk assets “explosion”

- US valuation on P/E now at +1.2x std. deviations going back to 2003; down from 2.2x year ago

- Late ’21 Fed acceleration/confirmation of rate hikes and taper began valuation normalization

- Expectation (and reality) of higher rates slowing growth earnings multiples

- Investors growing uncertainty on growth duration outlook lowers earnings multiples

- Geopolitical issues have also played a part – like bankruptcy, it happens slowly and then all at once…

- IPO market shut down, only companies with stable business models and ebitda/earnings will be coming forward

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’ and IPIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments