The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

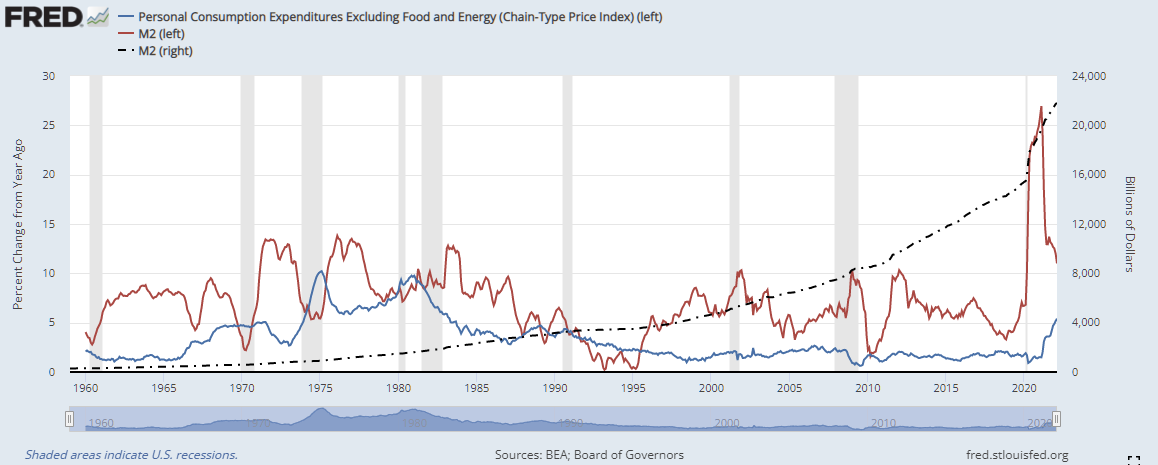

Peak inflation…or new drivers to take over? Watch M2 Y/Y growth…

- M2 Y/Y growth (red line) now 11%, returning to high end of “normal” levels of past 40 years

- Only the mid ‘90’s saw M2 Y/Y growth approach negative…Fed resolve can be questioned

- Prior periods of PCE Index (blue line) at 5% or greater do exist but have to go back to 1980’s

- With M2 growth sharply receding, this could add new calculus to inflation figures

- Recent PCE core index reported 5.4% increase…lower rental car rates; higher gas and food prices

- Fed has stated it wants to reduce balance sheet by $90B/month, ~ $1T per year…will it actually?

- Fed has two ways to reduce balance sheet: remove excess reserves or actual reserves in system

- If Fed no longer pays interest on excess reserves, banks will not want to hold excess reserves

- Draining excess reserves from the system should not have impact on inflation rate

- Draining actual reserves could impact lending and potentially cause credit squeeze

- However, shadow bankers will likely take the opportunity to provide credit helping economy

- Conspiracy Theory: Government has stopped publishing on excess reserves (link)

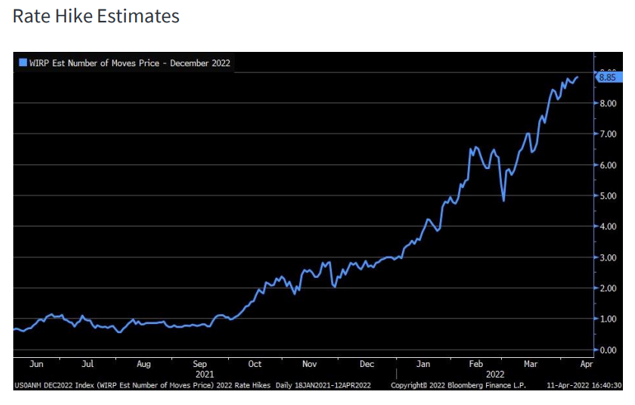

Do I hear 10 rate increases?? Bond market positioning is currently one-sided…

- Fed statements and inflation prints have spooked the credit markets, yields continue higher

- Market is now discounting 8-9 Fed Fund rate hikes over the next two years

- Bond market (Bberg Agg) is having worst performance in over 40 years, this is a rout…

- Tactically speaking, what could alter the markets thinking on inflation and rate hikes?

- We believe that economic growth continues to slow, Atlanta GDP Now at 1% for 1Q22

- If economy can’t rebound into mid-term elections, Powell may replace Putin as the White House’s chief culprit for price hikes

- Might we see a hot employment market cool off? Perhaps, we saw labor force participation increase last month as higher wages moved people off the couch

- Any edge coming off inflation prints could cause a re-think on rate hikes…OPEC’s Monthly Report recently reduced global demand numbers supply response, will there be a demand impact; used car prices peaked; rents and gasoline taking over…

- We are looking for the right time to take a contrarian bet – eyeballing high yield

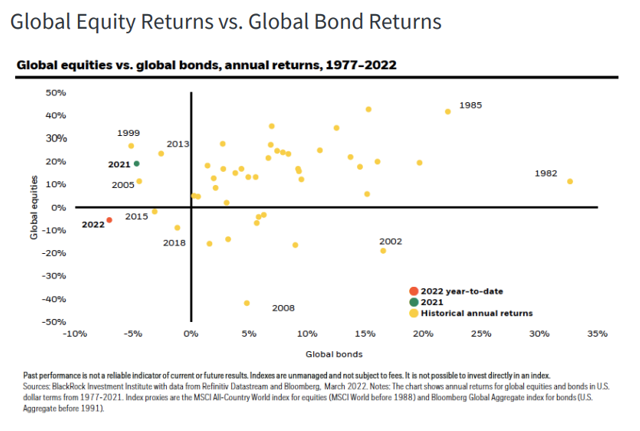

No place to hide thus far in 2022…both bond and equity returns negative

- As noted, the bond market (Bberg Agg) has is experiencing its worst year since mid-1970’s

- Equity market returns (MSCI ACWI) are also negative but attempting to return to breakeven

- We think that bond markets are overdone to the downside and are looking for oppty’s

- We still think credit quality remains ok, High Yield appears attractive with 6% yield

- Longer duration government securities provide a trading opportunity for bond rally

- Equity market returns (SPX 500) are lopsided by sector – energy the clear winner, up 46% YTD

- Utilities and consumer staples up 5.7% and 1.6%, respectively, are only groups in the green YTD

- Energy, utilities and consumer staples represent only 12.5% of SPX 500

- Yesterday’s hero’s: Technology and Comm Services down 15.5% and 16.5%, respectively

- FAANG worst performers YTD: NFLX and FB down 44% and 37%, respectively…compares to AAPL (-7%), AMZN (-8.4%) and GOOG (-11.6%)

- Together, FAANG represents 14.3% of SPX 500…accounts for 22% of SPX 500 7.85% YTD decline

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’ and IPIS’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments