The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

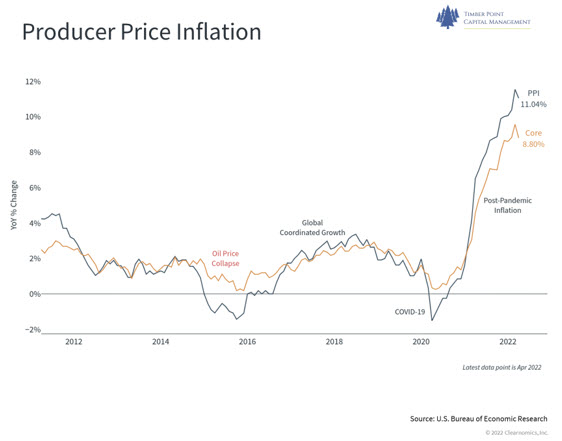

It is shocking that inflation prints are no longer shocking…

- Recent PPI print above 11% for the second consecutive month, worst levels since early ‘80’s

- If exclude food and energy, core at 6.9%…but that misses the issue impacting consumers most

- Food and energy goods final demand were higher by 1.5% and 1.7% y/y…will be moving higher

- Services final demand led by truck transportation, up 4.4% y/y…rates higher to offset labor cost

- Intermediate demand elements up 21.9% and 48.1% y/y for processed and unprocessed goods

- The Fed cannot be all things to everyone…should focus on dual mandate of price stability and employment – not climate control, abortion, income redistribution

- Policy prescriptions to help alleviate energy costs are not forthcoming from Biden – continues to limit federal lease sales, block pipelines, increase regulatory burden on producers

- Russian invasion of Ukraine resulting in sustained higher food prices due to shortages and higher cost of fertilizers and pesticides – Russia a major exporter of nitrogen, potassium, phosphorous

- Avian flu outbreak is worst since 2015 pushing egg and poultry prices higher

- We may be at “peak” inflation but that does not have to mean that we will see a quick reversal…

Q122 earnings are in…estimates go higher, valuations lower

- 91% of S&P 500 has reported…blended EPS growth rate of 9.1% is lowest since Q420

- However, are comparing vs. 1Q21 EPS growth of 91.1%, highest growth rate since 2008

- 77% of companies reported EPS > estimates, in line with 5-year average

- Magnitude of EPS > estimate was 4.9%, below 5-year average of 8.9%

- EPS growth of 9.1% for 1Q22 compares to 4.6% estimate at end of 1Q22 (March 31st)

- Nine of eleven sectors reported y/y EPS growth; Consumer Disc and Financials did not

- Analysts estimate 4.4%, 10.3% and 9.8% EPS growth for coming quarters and 10.1% for 2022

- Using $204 for 2021 S&P 500 earnings, implies $225 eps for C2022…18x P/E for 2022 S&P 500

- EPS estimates for 2Q22 are either too low…or 3Q/4Q ’22 estimates are too high, in our opinion

- P/E’s still greater than 10-year average: Discretionary, Staples, Utilities, Technology

- Energy is best performing sector for the year, yet valuation is deepest discounted at only 2/3 of 10-year average

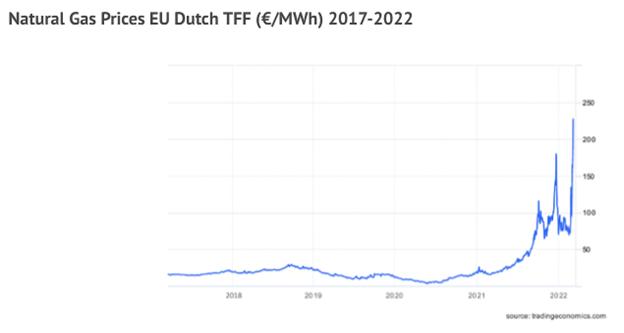

Natural Gas prices continue to move higher…

- Prices climbing on both sides of the Atlantic; EU prices are up 7x y/y, US prices up 2x

- Supply is tight globally and delivery tenuous; geo-political and regulatory issues abound

- Russia has curtailed gas supplies to Poland and Bulgaria in April; was also curtailing volumes before the invasion resulting in less than optimal storage volumes

- Ukraine is home to infrastructure that transports 1/3 of Europe’s imports of Russian gas and is threatening to stop transport of Russian gas through country network

- 40% of EU natural gas comes from Russia, at times 75% of Germany’s natural gas sources…

- Price spikes are impacting electricity and heating prices; EU struggles with response

- LNG as a swing source avoids fact that spot cargoes are few and new capacity takes time

- Missile strikes continue in Ukraine which puts equipment at risk and repairs unlikely

- EU attempting to sanction Russian oil but still allow ruble payments for Russian natural gas

- The IEA outlines a 10 point plan for EU to lessen its dependence on Russian natural gas imports

- EU faces a multi-year challenge to reduce its reliance on Russian natural gas supplies

- EU and other countries will need to reevaluate natural gas as a “clean enough” fuel alternative and reconsider transition pace away from fossil fuels

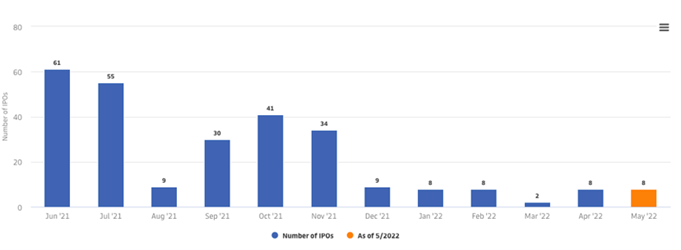

Number of IPO’s over Trailing Twelve Months

Source: Renaissance Capital

IPO’s are dead…private “marks” may be the next shoe to fall…

- Number of IPO’s priced YTD total 34, a 77% decrease over same time span in 2021

- We estimate over 600 SPAC’s are still searching for targets…extend and pretend is the game

- Higher inflation has hurt growth stocks which most deSPAC’s tend to be…expect more SPAC’s to pull the plug on acquisitions

- Alternatives space benefits from lags in valuation “marks” versus mark to market of public’s

- Decline in public market valuations will soon translate to private companies seeking funds

- Excesses existed in the banking system in 2008, now it is hiding in “shadow banking”

- BDC’s, private equity, even insurance companies are packaging product with limited covenants

- Credit markets typically the first to show strain…investors seeking yield have rushed into new instruments paying PIK coupons…

- Regulatory regime in shadow banking is largely non-existent and ripe for excess

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments