The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

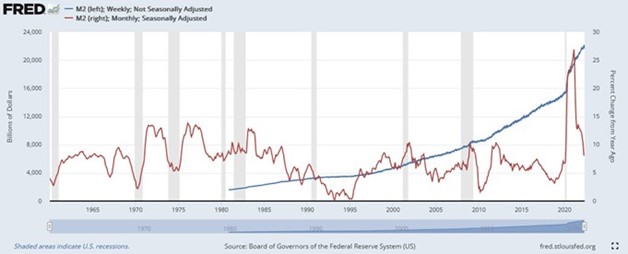

M2 growth continues to return to longer term levels…

- M2 growth, now 7%, continues to decline y/y but still growing off elevated pandemic levels

- We expect M2 growth to go negative for the first time in history as Fed reduces balance sheet

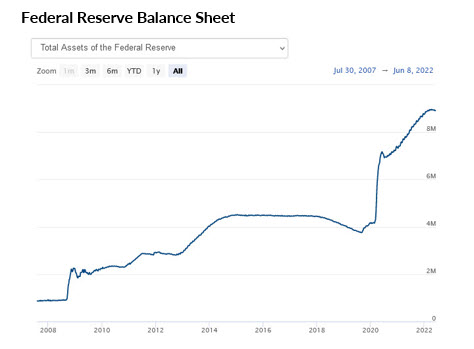

- Fed to reduce its balance sheet via “run-off” of its $9T treasury/agency/mortgage portfolio

- Starting June 1, 2022, Fed will only reinvest principal payments from maturing securities that exceed monthly “caps”

- For treasuries, first cap is $30B/month for 3 months and then $60B/month thereafter

- For agencies, initial cap will be $17.5B/month for 3 months and then $35B/month thereafter

- Fed balance sheet reduction will be adjusted “in light of economic and financial developments”

- Fed focus continues to be on “core” PCE; it cannot impact energy or food prices

- Despite “hot” CPI print and market sell-off, Fed likely sticks with planned 50bp hikes in June/July

- Investors believe that the Fed is behind the curve…we agree it was, market helping it catch up

- Powell’s renomination gives him job security past Biden’s first term – does that imply he will be more hawkish? Not necessarily, he wants to see a soft landing…

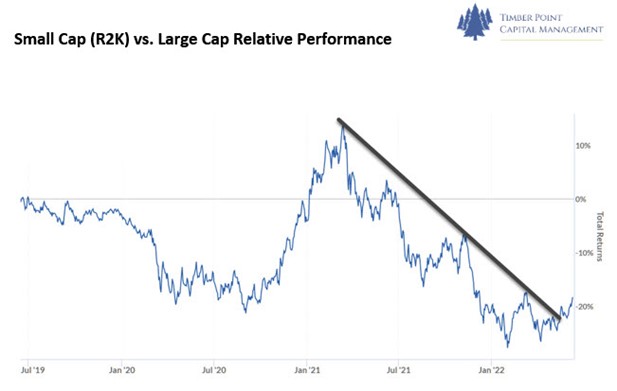

Small Cap relative performance and valuation are intriguing…

- Since their peak in early ’21, small cap performance has been dreadful vs. R1K!

- YTD performance for small (-20%) has been worst on record

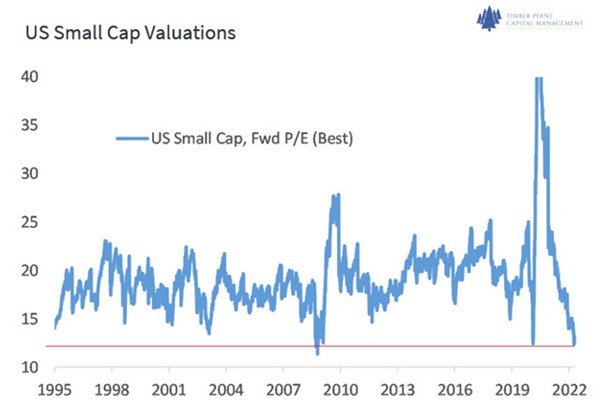

- Given price decline and still resilient earnings, valuations are approaching 25-year low levels

- Small caps as % of US market is now sub 4%, below ’73 and ’02 bear market levels…both started periods of extended small cap outperformance

- Reason for continued concern: recession fears given high % of domestic revenues and higher cost of high yield debt financing with rising rates

- Historically, small caps underperform large leading into and during early part of recession before beginning a period of relative outperformance prior to the recession ending

- We continue to watch earnings estimate revisions, do expect some degradation of estimates

- Recent relative price performance indicates that small caps may have become oversold and or we aren’t going to see the much-feared recession

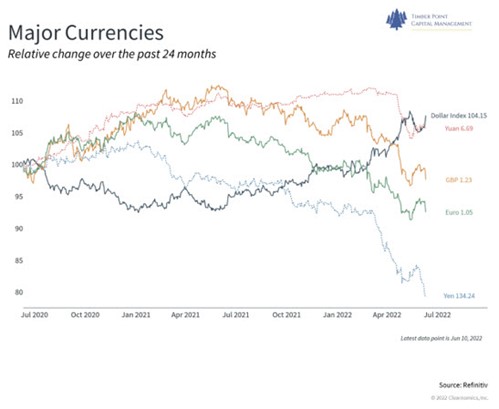

U.S. Dollar continues strong vs. global currencies…for how much longer?

- Aggressive plans for Fed hikes and resilient US economy make USD the relative FX winner

- Coincidentally, the USD is the safe haven in difficult geopolitical backdrop

- Dollar/Euro nearing parity for first time since 2000…summer vacation in Paris, anyone?

- ECB now to begin rate hikes and end bond buying program given inflation spiking similar to US

- Concerns over ECB tightening reignite concern over larger debt loads of Italy and Greece

- Italian yields jump to highest levels since 2014; yield gap widens between Germany and Italy

- Who will buy Italian debt if ECB doesn’t? Fear spreading to European bank stocks…

- Yen also hitting 20-year low vs. USD…typically the yen has been a safe haven in times of stress

- Bank of Japan continues low interest rate policy, although seeing hints of long awaited inflation

- Weaker yen a boon for exports but USD based energy commodities serving as offset in economy

- Interestingly, EM has been outperformers during USD ascent, not the typical pattern for economies with large USD denominated debt

- Forces in play won’t turn around overnight, but our sense is that the USD will take a breather soon

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments