The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

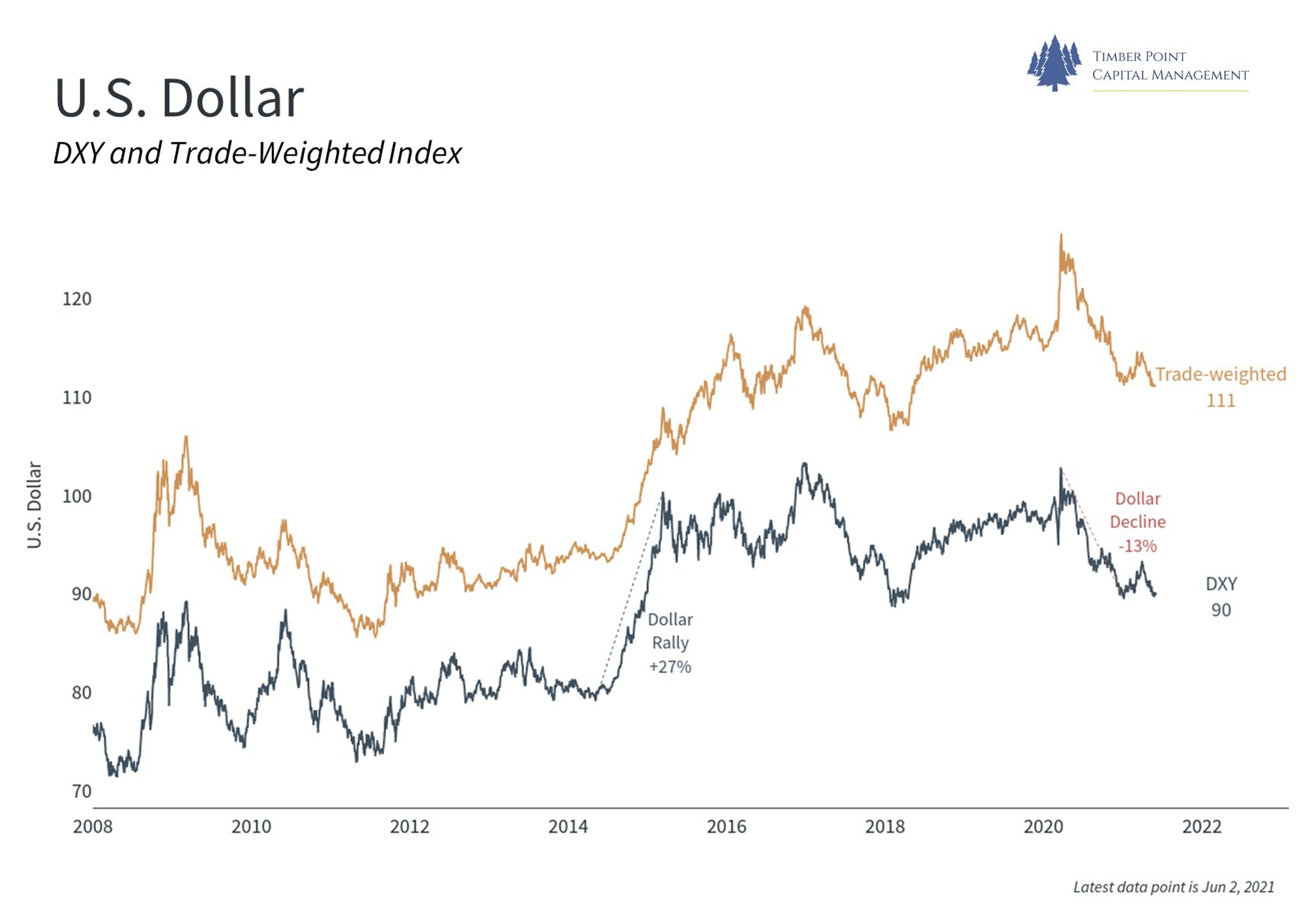

Dollar decline continues, see early signs of ROW market outperformance in month of May

- SPX best performer TTM and YTD…in May, Europe +5%, Japan +1.5%, EM +2% vs. SPX +50bps

- US real interest rate differential declining vs. ROW as US inflation picks up = more pressure on the dollar

- Strong $ periods: Contract with America (1996), GFC (2008); Fed funds normalization (2014), Trump era

- Purchasing Power Parity line…when $ is above PPP line, US markets outperform ROW…view via FRED

https://fred.stlouisfed.org/series/DTWEXBGS - Conclusion: gap b/n US excess return and ROW is narrowing but still exists; watching ROW markets

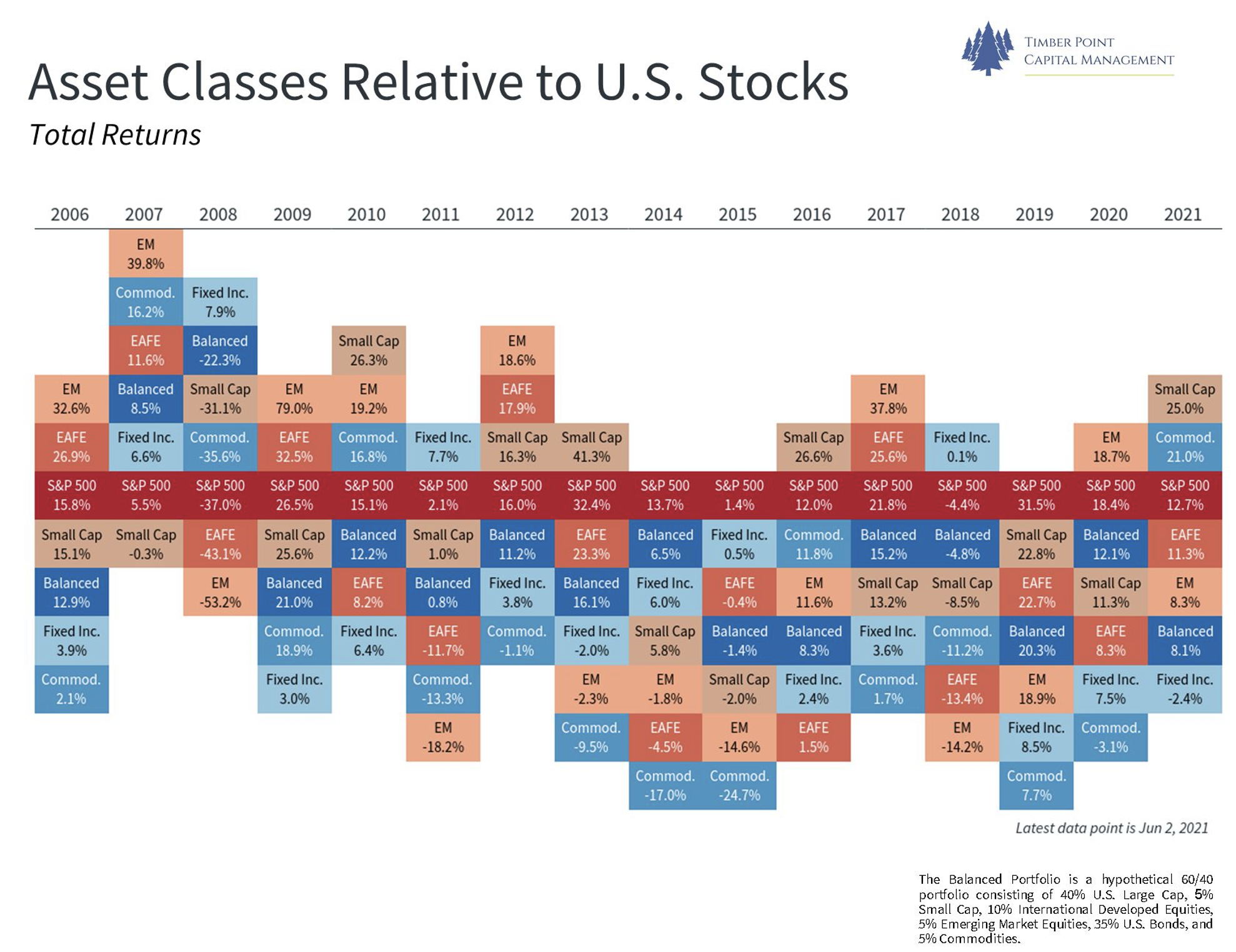

International market performance (EAFE) hot on heels of SPX 500 return YTD 2021

- EAFE & EM have outperformed SPX return in only 5 of past 15 years

- Dollar decline nearing end in 2006/2007 = EAFE/EM outperform; dollar rally in 2008 crushed EAFE/EM

- Vaccine rollout in US far exceeds ROW…ROW had far stricter and longer lockdowns = easier compares

- ROW could post advantaged growth vs. US as they emerge from Covid while US growth normalizes

- Biden budget predicts 2% GDP growth, taxes and regulations returning US to “new normal” growth levels

- Conclusion: further dollar decline and vaccine resolution in ROW could turn tide for ROW markets

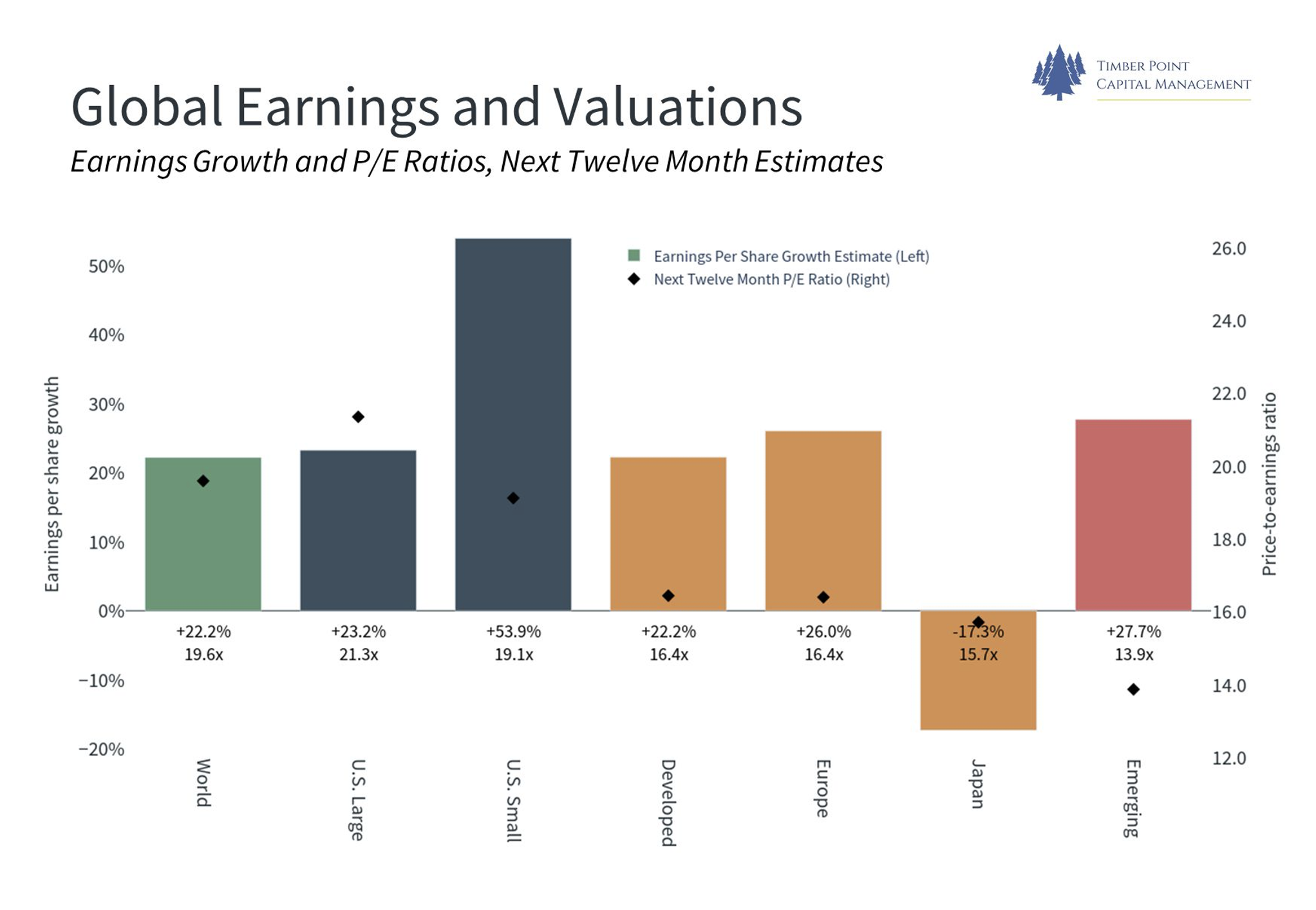

US markets are fairly valued in slowing growth environment; ROW valuations hard to ignore

- 5-6x multiple spread on P/E valuation between US and ROW, bigger valuation gap vs. EM

- US deserves valuation premium owing to accounting standards and perceived financial stability

- Increasing evidence of lack of fiscal discipline with recent $6 trillion budget proposal after ‘20/’21 stimulus

- ROW markets diversify portfolios but can create challenge for US investors to match SPX 500 return

- Value outperforming growth, small domestic > large; will ROW markets join reversion?

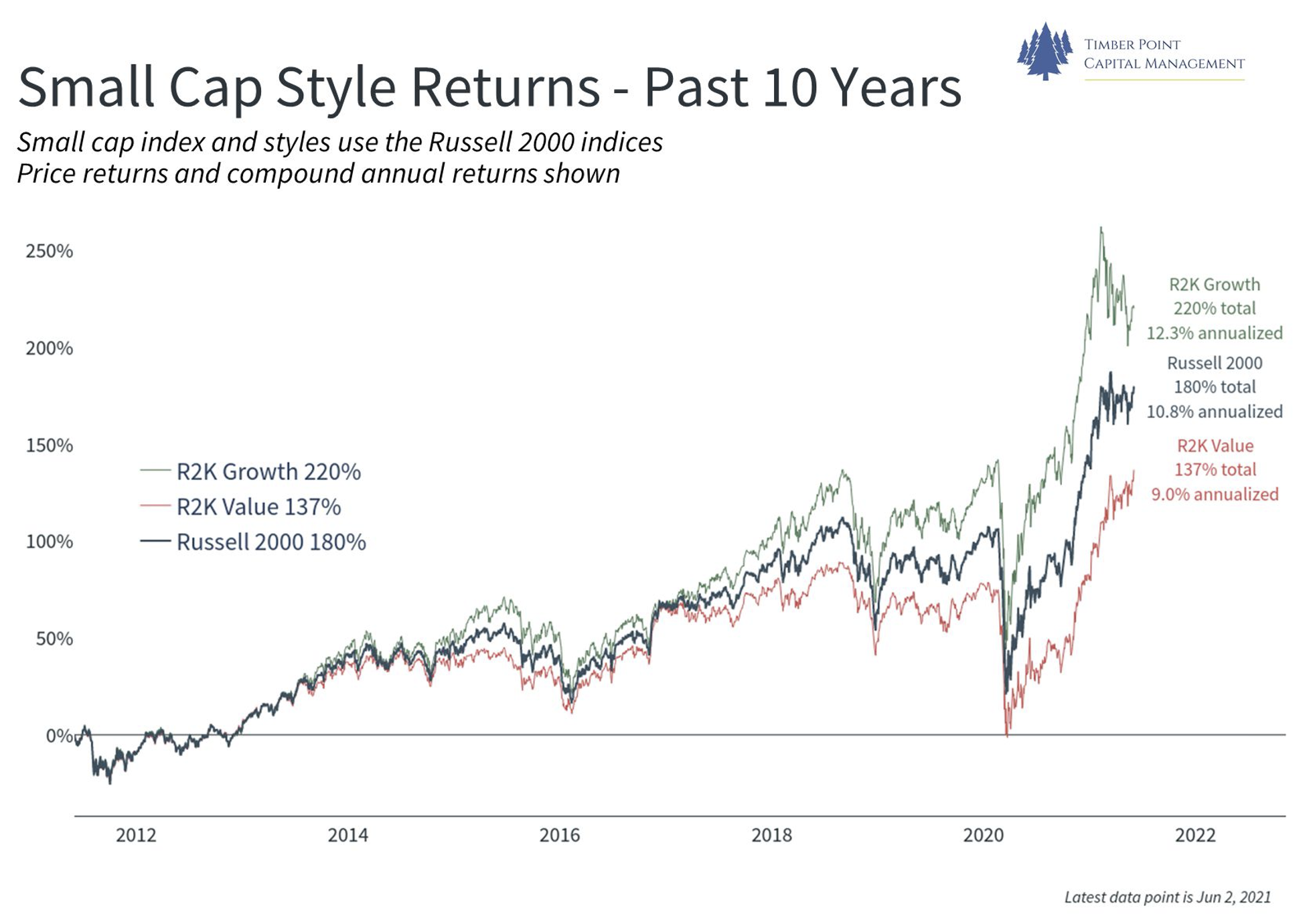

Small caps outperforming Large Caps, Value w/in small cap space far outpacing Growth

-

- Small Cap Value (IWN) outperforming Small Cap Growth (IWO) by 2700 bps YTD & 3000 bps TTM

- Since March 2020 bottom, IWN up 125%, IWM (Core) up 112%, IWO up 97%

- Technology and Healthcare sectors only 11% of IWN vs. 51% for IWO

- Largest IWN ETF sectors: Financials (26%), Industrials (16.5%), Consumer Discretionary (14.5%)

- Top IWN ETF holdings: AMC Entertainment (1.5% weight) and Gamestop (1.04% weight)

Recent Comments