The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

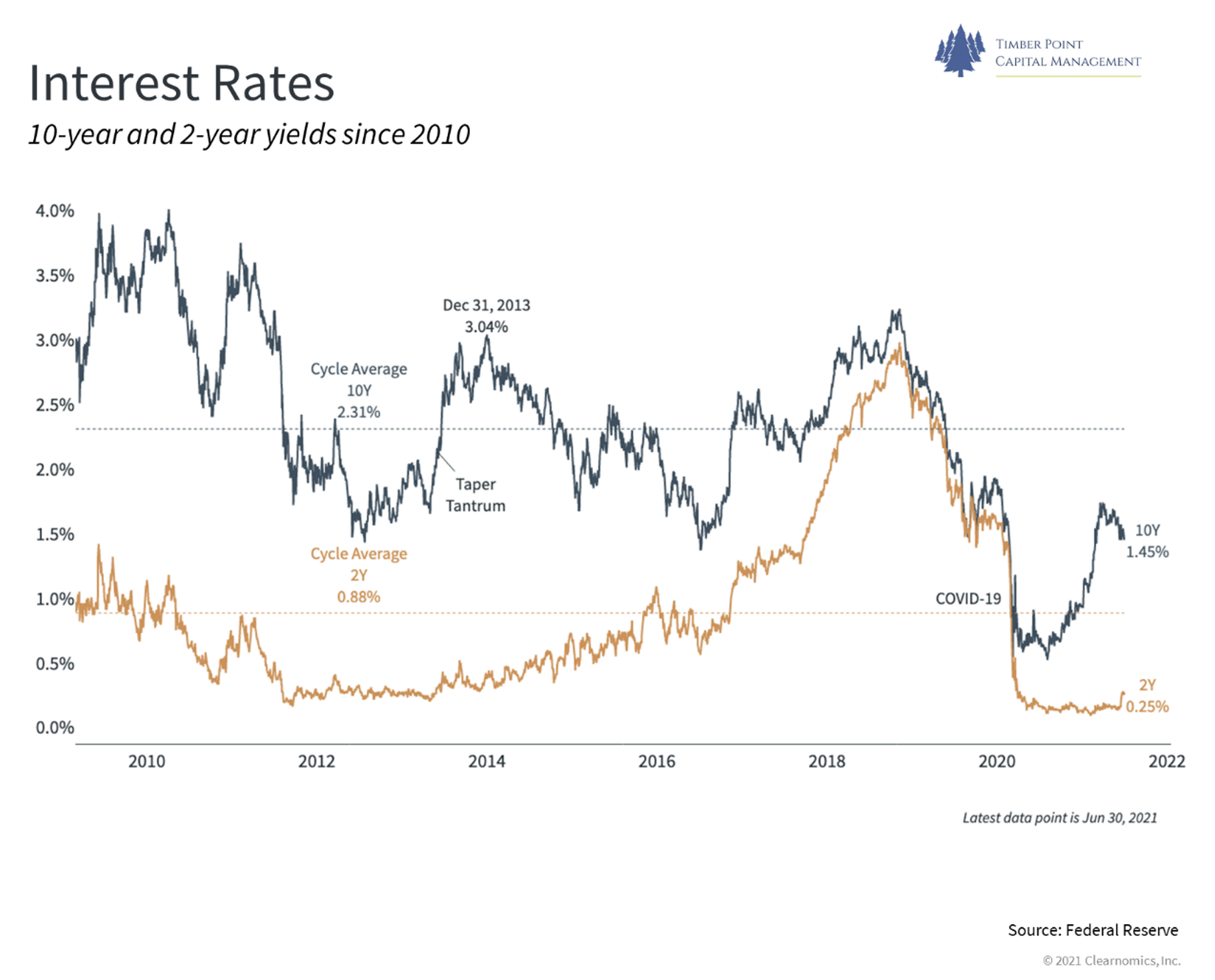

U.S. Bond market rally signals that inflation is not a problem

- 10-year yields have traded down to 1.48%, having peaked at end of 1Q21

- Market commentary remains focused on the bond market boogey-man, price action says otherwise

- Other than Covid induced yields sub 1%, 1.5% on 10-yr has been line in the sand (’12, ’16 and ’19)

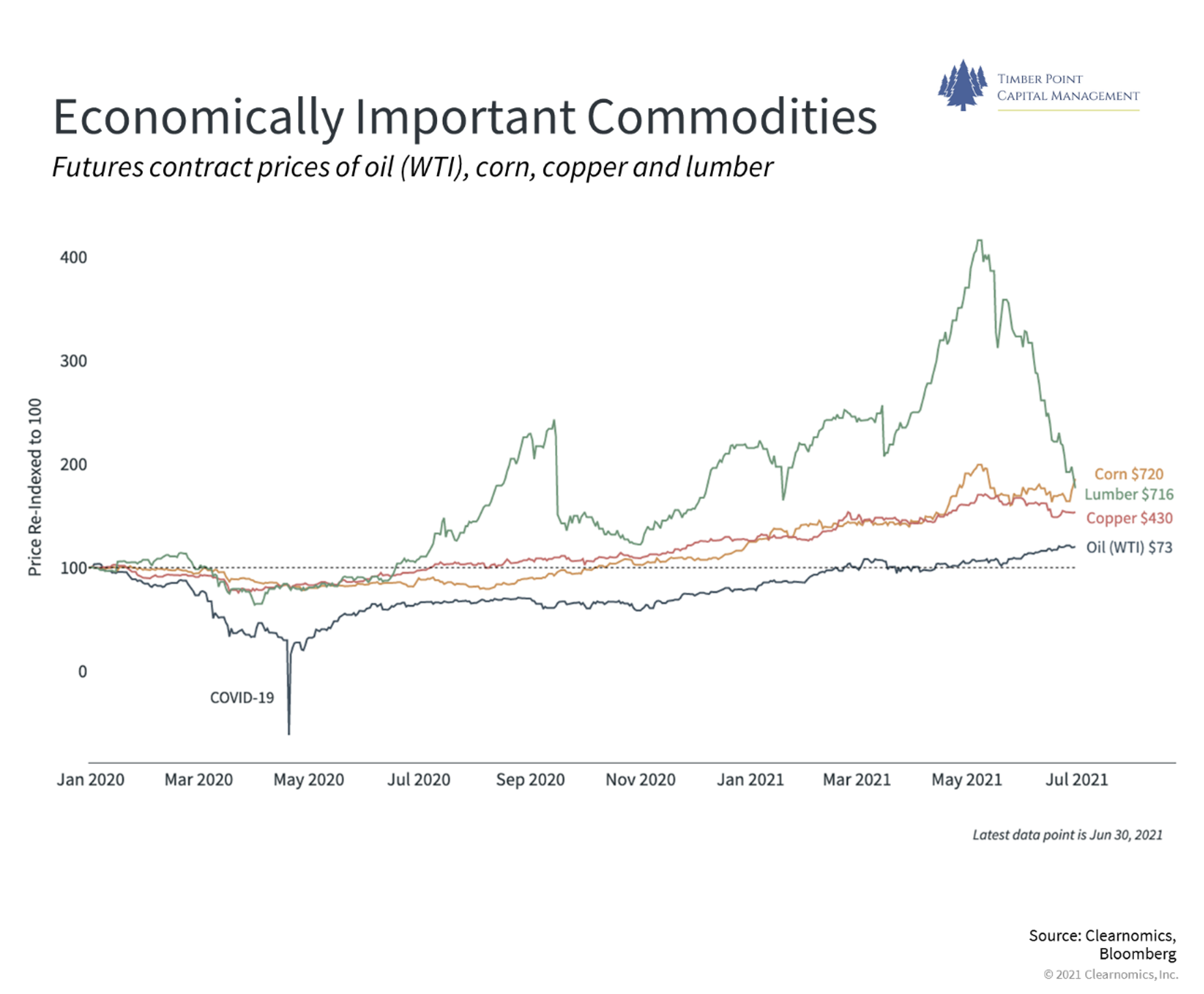

- Commodity rally rolling over, economic growth and unemployment concerns indicate slowing economy to trendline growth of ~ 2% being factored in

- Saw CPI y/y spike to 4% in 2007, what worked? EM, commodities, EAFE – We think U.S. still the place to be for risk assets

- Fed trying to improve unemployment rate, could be the impetus for higher inflation but in medium, not near, term period

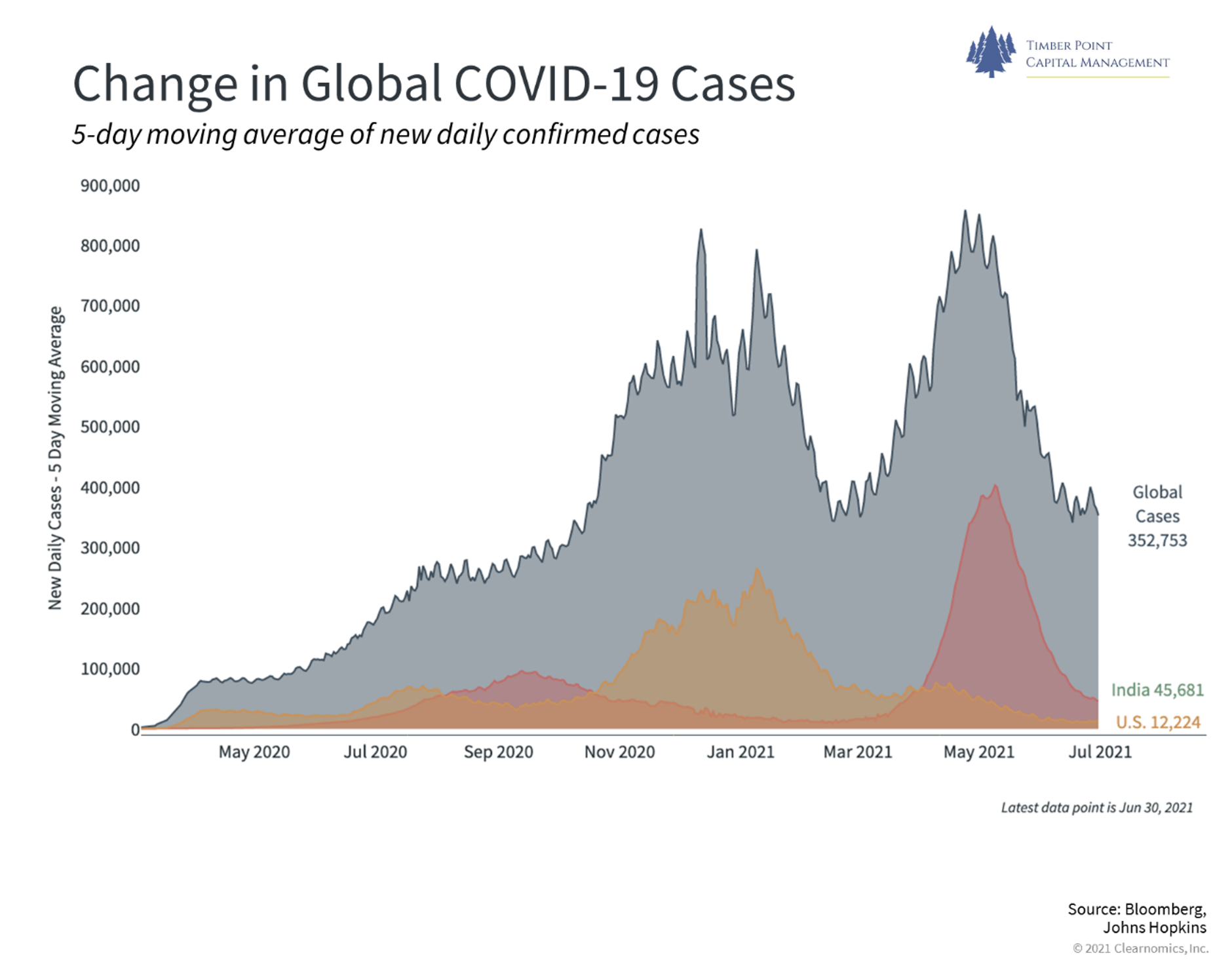

Vaccination rates and effectiveness vary across ROW

- U.S. continues to lead the world with vaccination rates and decline in Covid cases

- LAM and Africa using Chinese vaccine by Sinovac which is < 50% effective…this is a problem for recovery in these markets

- JNJ vaccine only 60% effective and will likely require booster shots…

- Delta variant may be more transmissible but less harmful – focus on hospitalizations and deaths

- US politicians unlikely to walk back “reopening” regardless of rising cases due to Delta variant

Commodities come off the boil…

- Solution to high prices is high prices…lumber peaked at 1750, now down under 800…

- Logistics constraints ebbing, transport names under pressure = XPO, CSX and KNX all lower

- Extreme heat across US causing surge in natural gas prices

- Crude oil continues higher – rig count barely budging as ESG concerns predominate

- U.S. oil production off 15% vs. 2020, spigots turning on in ROW, not the US

- Lower bond yields signaling end to commodity trade, secular growers picking their heads up

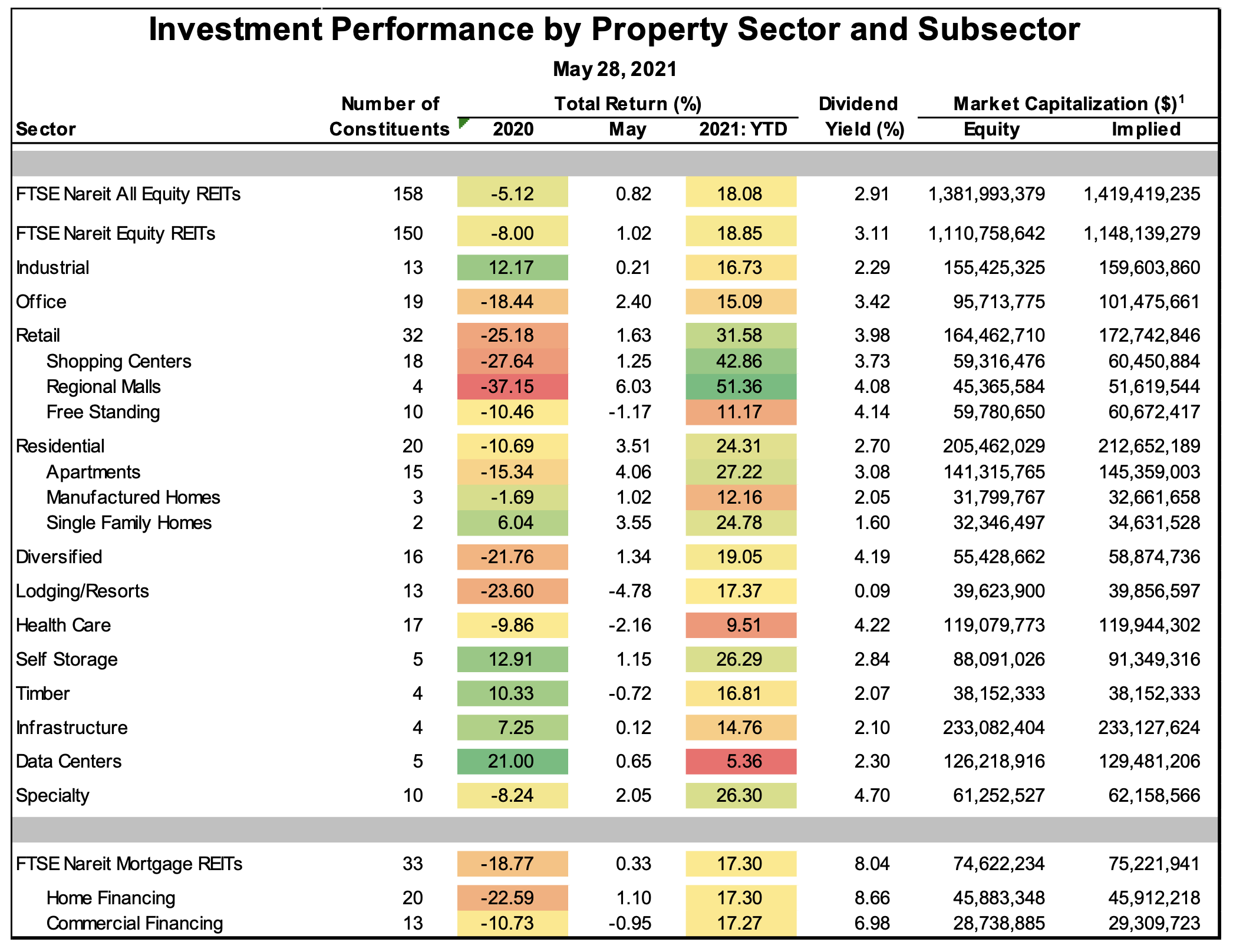

REITs are 3rd best performing group in SPX 500…we are surprised!

- Must dig into REITs as there are numerous sub-groups driven by different economic factors

- Reopening REIT’s have had a strong year – Retail and Residential sub-groups the best

- Data Centers were strongest during pandemic, now the worst

- Yields compressed in 2% – 4% range, are investors being adequately compensated for risk? No.

- Continued shift to hybrid workplace and online commerce should impact leading groups

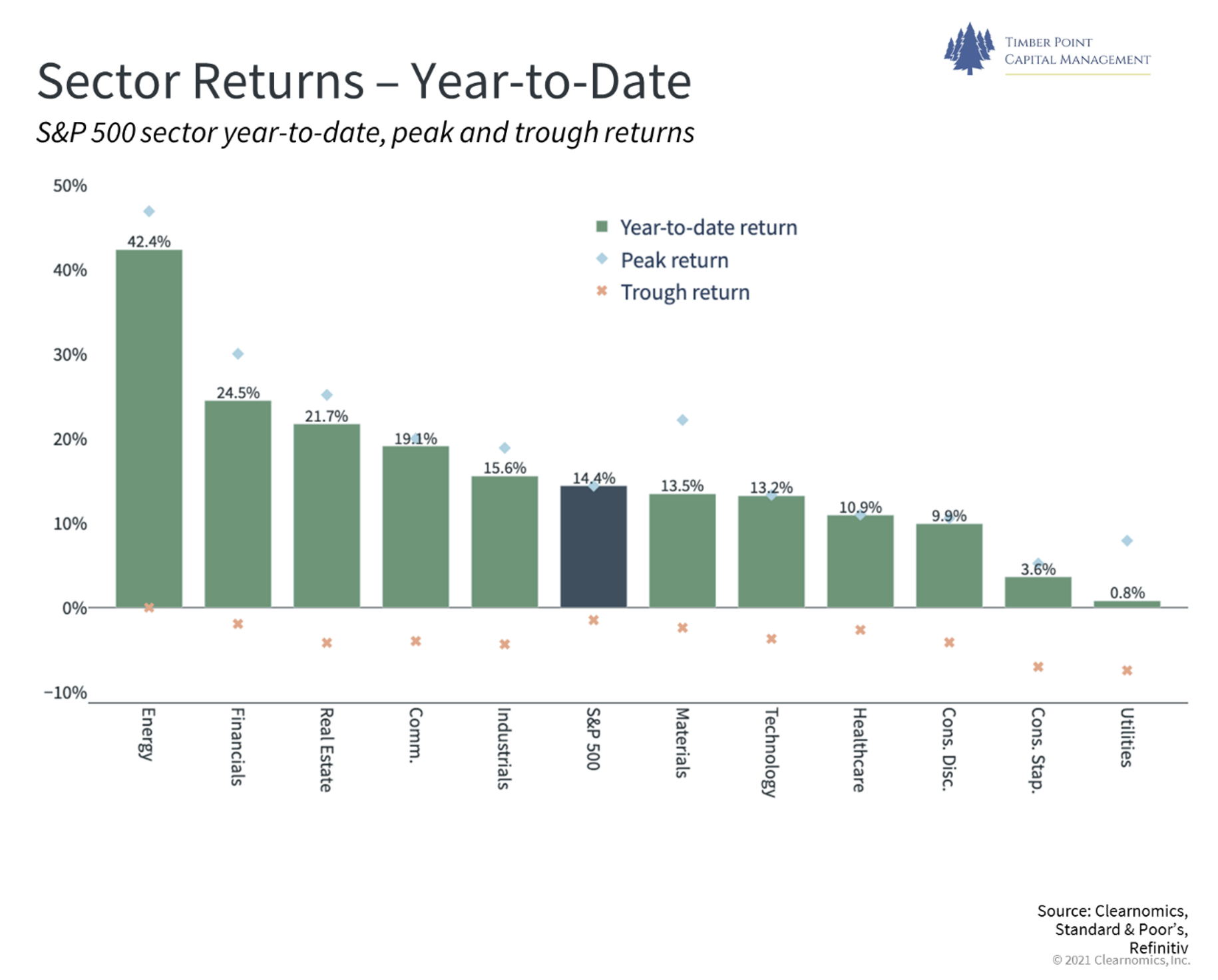

Returns are strong thus far in ’21, what are we concerned about?

- Distortion in the bond mkt due to central bank intervention

- Economy growing on fumes – each $1 trillion in Fed purchases = 25bps rate decrease in fund cost

- Volatility extremely subdued, % of names below 20- and 50-day moving averages growing

- Rolling corrections have left SPX 500 at new highs, secular growth now rebounding

- Continued growth in public sector as % of GDP

- Entitlement programs expanding by executive order, very tough to cut it back once granted

Recent Comments