The Timber Log is a quick overview of Timber Point Capital’s weekly investment meeting. If you would like to join the call or have questions about the content, please reach out to Patrick Mullin at pmullin@timberpointcapital.com

The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

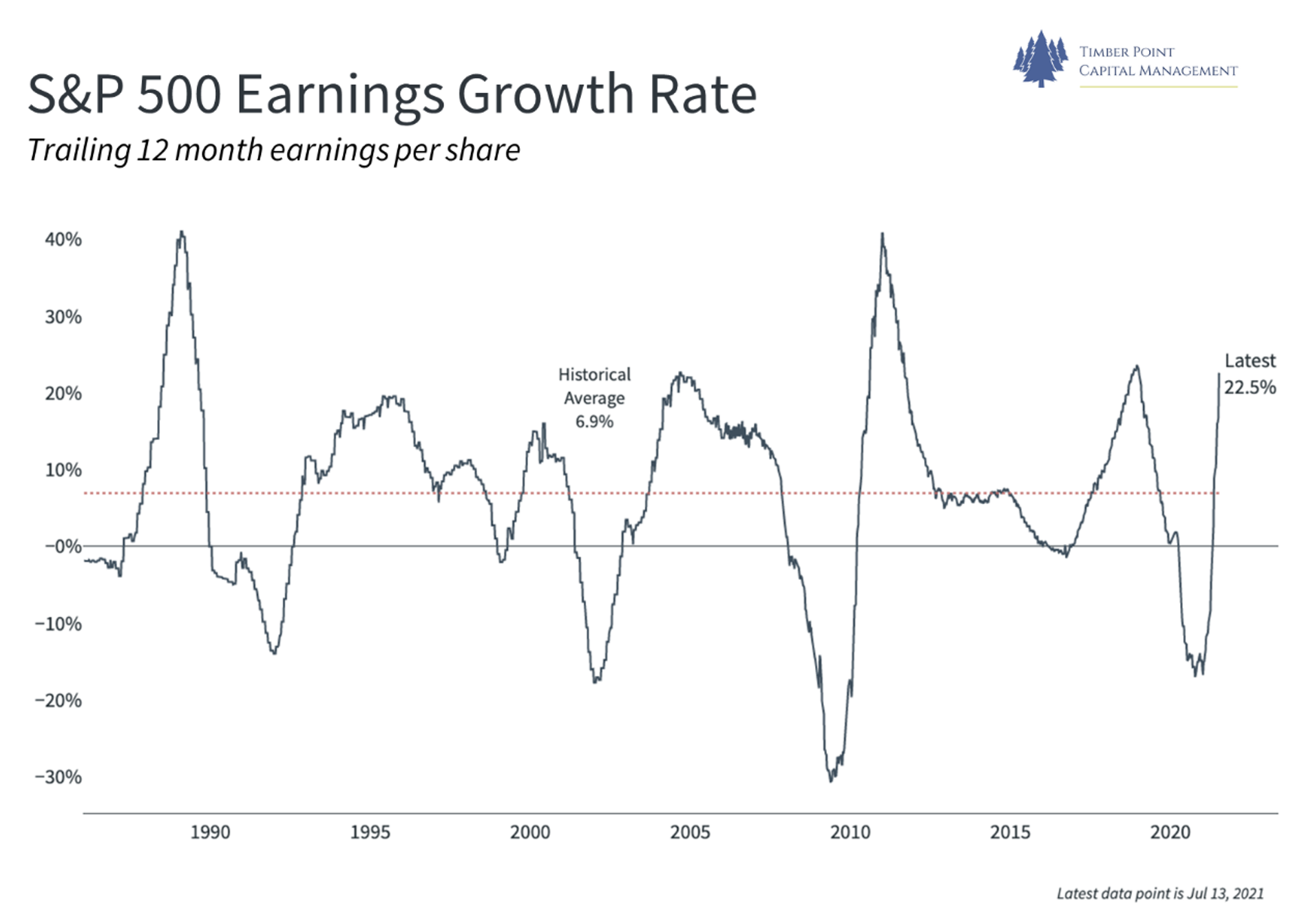

Market rebounds after selloff…longer term EPS growth estimates are the key

- Y/Y eps growth estimates set to decline sequentially going forward from easy Covid compares

- We think sustainable growth returns to 2%-ish, even with accommodative Fed into 2022

- Biden administration policies are more of a hamper than help on future growth estimates

- ROW struggling with Covid/delta variant = rebounding dollar and flight to quality in US FI market

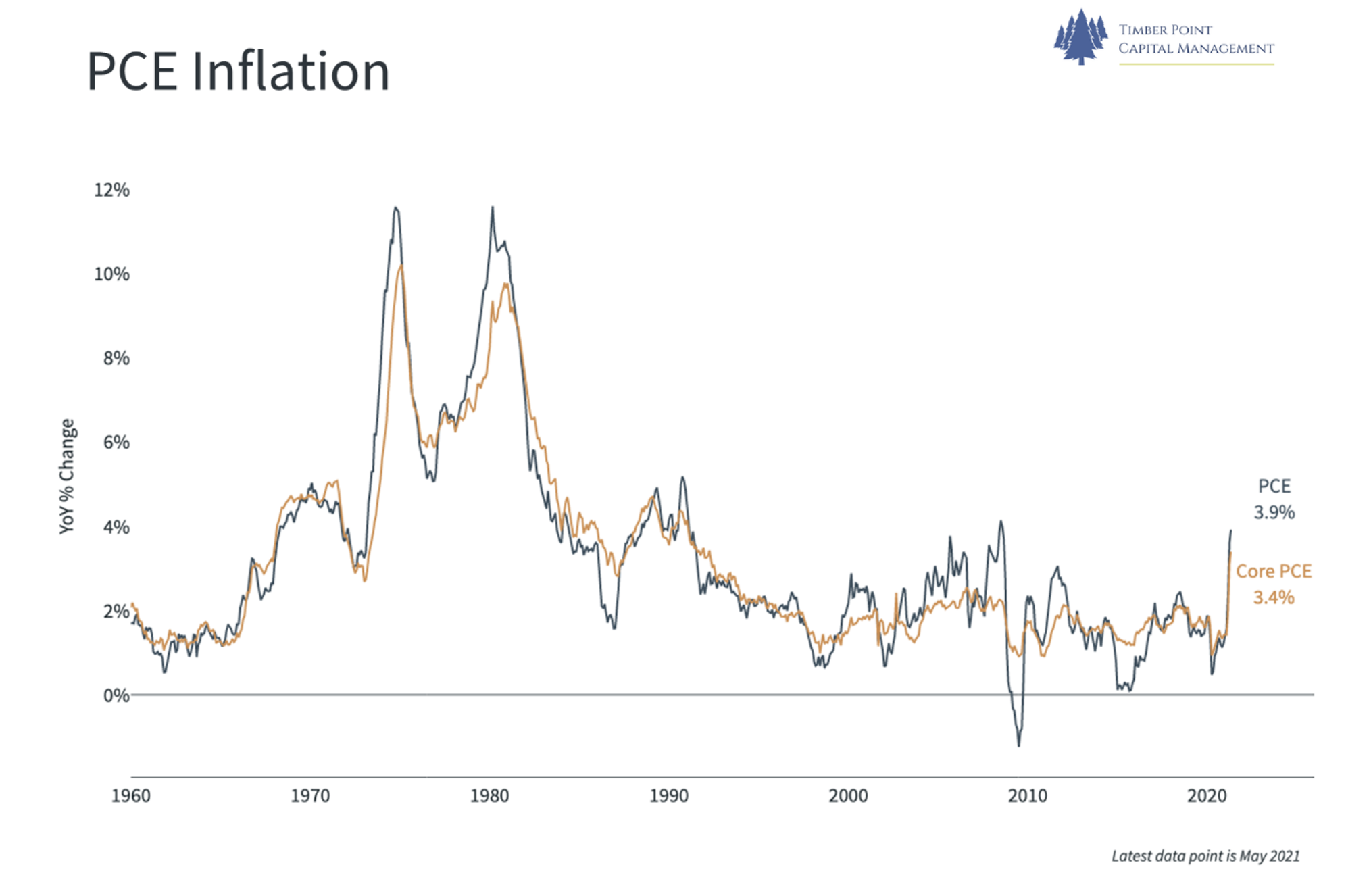

- Inflation largely a factor of supply dislocations that linger on from Covid…are resolving

- Yes, monetary policy is a tailwind but much of stimulus is in excess reserves vs. economy

- Opportunistic trades – Covid recovery plays in equity market, long Treasury trade played out

Supply dislocations continue to result in higher input prices – A special report from TPCM summer interns!

- Supply dislocations across the economy a function of shuttered operations, canceled orders and now surging demand post Covid-19

- Supply chains are recovering but prices in many key industries remain elevated – shortages have been key drivers of inflation metrics

- Well known shortage is labor – service industries are struggling to find people, as are other industries

- Wage/salary levels now above pre-Covid levels, starting to show in official figures

- $300/week Federal supplemental unemployment insurance will expire nationally Sept 6th; 23 states have opted out starting in mid June

- Industries most impacted: Autos (chip supply); Restaurants (labor, chicken wings); Guns/Ammo; Home Builders (lumber, steel, copper);

- Used Car prices elevated due to lower new build levels…have you tried to rent a car lately??!

- Food prices continue to escalate due to supply dislocations and bad weather; CMG prices up 4%

- Shortages impacting inventory levels at retailers resulting in record low inventory:sales ratio

- Port congestion has been a real issue, now handling record volumes in LA – total US bound container shipments up 18.3% from May, 2019 – this is a positive!

Sample of Company Headlines/Comments:

- Vista Outdoor: “Federal has made more hunting ammo this year than in past 99 years of company”

- Wingstop: “Wholesale price of wings a year ago was 98 cents per pound…Today, it’s $3.22.”

- China car sales down 5% in June to 1.58 mln, largely a result of supply shortages

- BMW will produce 30K less vehicles in 2021 vs. budget – “shortage of chips will impact upcoming two quarters of sales.”

- NXP Semi: “Our current expectation is we will fact tight supply environment for at least the remainder of 2021.”

- CEO, National Ass’n of Home Builders: “While the recent drop in lumber prices is a positive development, the lumber crisis is far from over.”

Bottom line: Dislocations are real but will be resolved

- Supply of workers should be on the rise post Labor Day

- Profit motive will drive industry to find work arounds in all areas for workers and inputs

- Substitution effect is real – chicken wings now becoming chicken thighs

- Relentless technology innovation replacing human labor in service and manufacturing industries

- Double ordering likely real – will we see order cancellations in the Fall as supply normalizes? We think so.

- Price normalization will be a function of time for supply chains to stabilize – stay tuned for more on this as it is already and will continue to happen!

Recent Comments