The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

The economy has very few upbeat signals to point to as we enter 2H22…

- Atlanta GDPNow estimates 2Q22 economic contraction at (2.1%); 1Q22 GDP was (1.6%)

- Two quarters of negative GDP growth would certainly surprise the Fed…not the market

- A recession is “possible” according to Powell…”will depend…on factors we don’t control”

- The Fed cuts growth estimates for ’22 from 2.8% to 1.7%…’23 and ’24 growth to < 2%

- Yet the Fed still holds the line on future rate increases and quantitative tightening

- Consumer – inflation and gas prices eating into consumer sentiment and purchase intentions

- Consumer – personal consumption expenditures in May showed sharp sequential decline

- Industrials – Flash PMI New order growth fell in US, flat-lined in eurozone (S&P)

- Housing is in decline as higher mortgage rates and high prices crimp affordability

- Recovery trade is under pressure as airlines can’t find pilots and consumers balk at gas prices

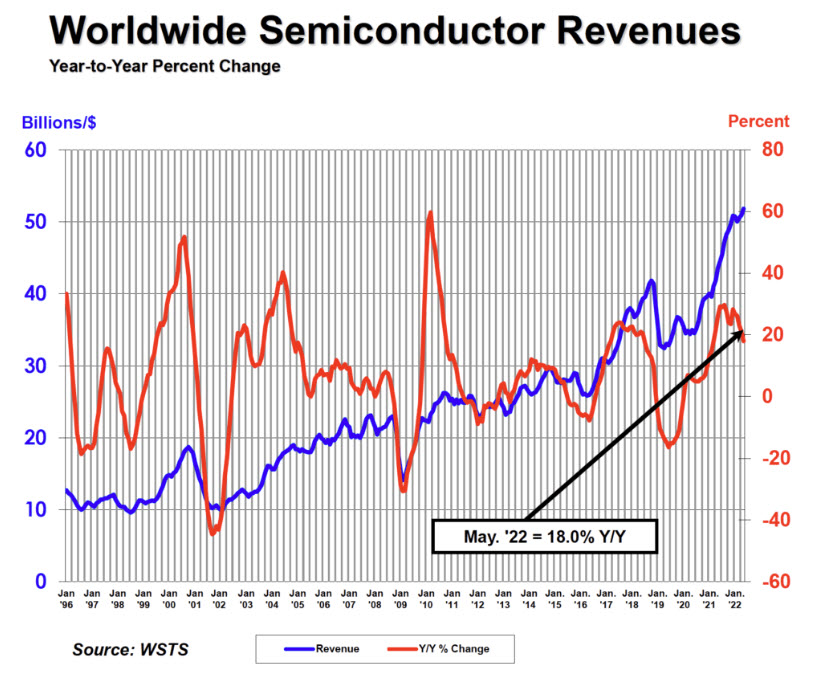

- Semiconductors (below), the ultimate Covid shortage item, showing weakened demand

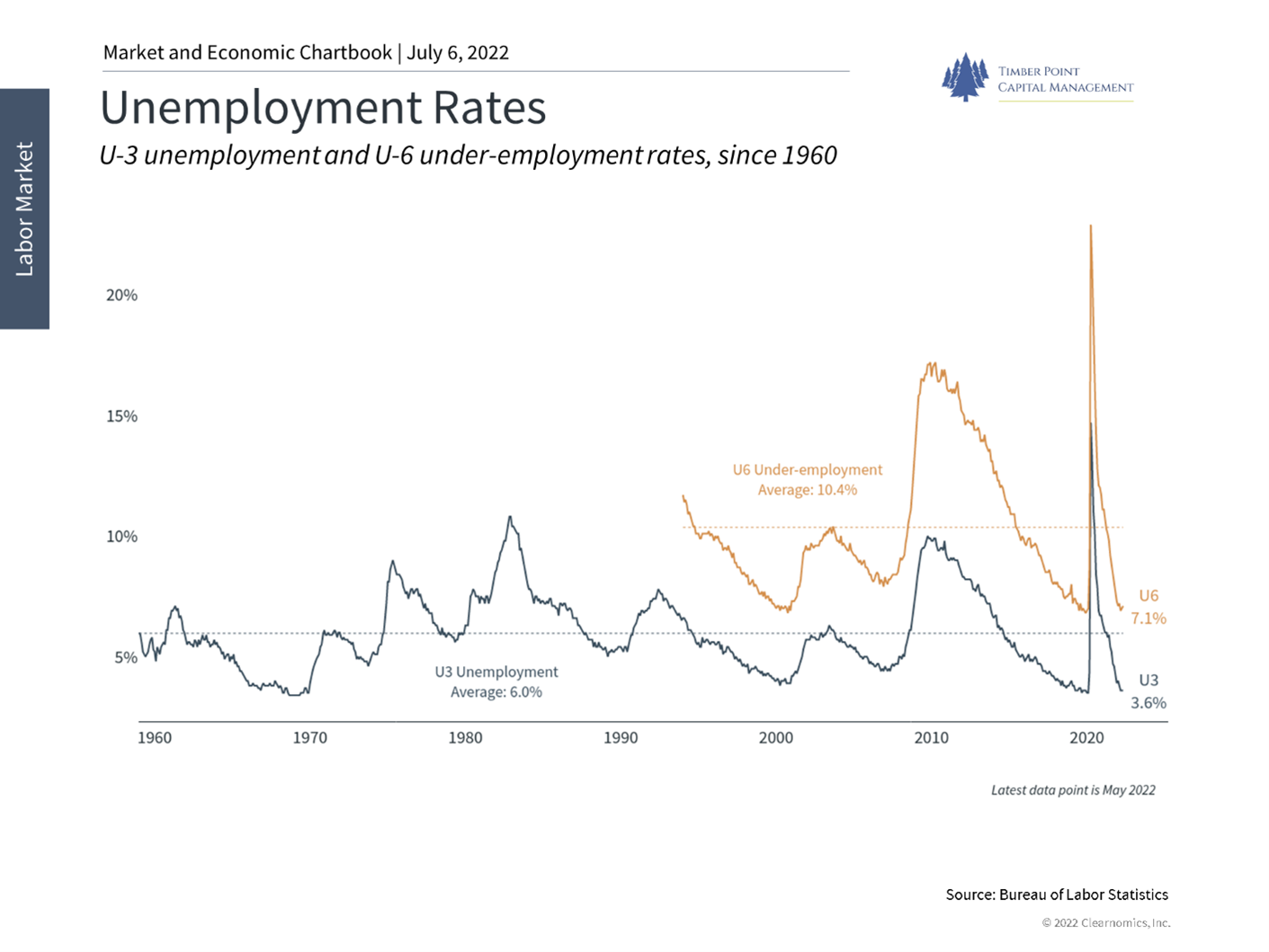

- Unemployment figures still low but recent headlines are full of stalled hiring and job losses…

- Glimpses of good news? peaking inflation, normalizing supply chain, rebounding China

- However, earnings estimate revisions still yet to come (Factset)…guidance season is upon us!

Semiconductor demand is normalizing…inventory issues to be resolved sooner?

- Intel warned of a continued shortage through 2024…Micron now rings bell for normalization

- MU CFO, “…a period where the market weakened considerably in a short period of time.”

- Bit shipments in DRAM (73% of revenues) and NAND expected down in Sept quarter

- Storage semis do serve secular growth markets – AI, cloud, EV’s, 5G…a good thing

- However, PC/smartphones are mature, and now in decline post Covid fueled ’20 and ’21 sales gains

- DRAM is largely commoditized…despite industry consolidation, margin gains require innovation and ongoing cost improvements

- MU taking “immediate action” to reduce supply, will manage inventory and lower capx

- Lower capx will impact semi-equipment company orders, backlogs will be worked down

- MU may be the tip of the iceberg in semis, we are interested to hear more specialized provider commentary (NVDA, MRVL) and foundries (TSM, Samsung)

- SMH and XSD weakness is not new, accelerating declines have occurred in past month

- Is bad news good news finally? We think market will need clarity on inventory in other sectors before a sustainable rally can occur

WHAT IF….Ukraine and Russia begin peace settlement talks…?

- We received an email this past week suggesting the above and that July may be a turning point

- A retired General, former Head of the US Army in Europe, suggesting Russia is extended

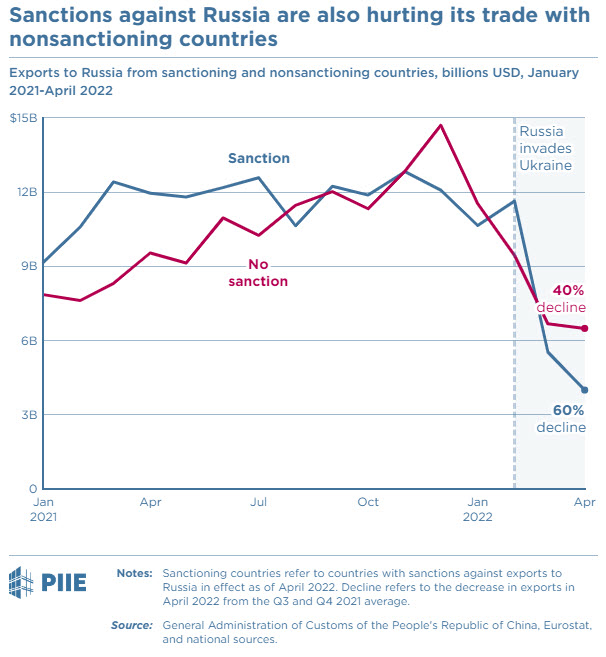

- Russia has inflicted damage and casualties on Ukraine, while sanctions have impacted its economy

- “De-modernizing” means that Russia can’t import critical parts, is left using old tools/techniques

- Over 1,000 companies have curtailed or left operations in Russia, across all sectors

- Importantly, “brain drain” continues, talented engineers and white collar employees departing

- GDP estimates are plunging as consumer activity slows, recession is highly likely

- EU’s decision in late May to largely ban Russian oil imports by end ’22 will impact 2h22 growth

- Militarily, Russia has been surprised by resilience of Ukraine and its allies

- It is estimated that 85% of Russian forces are now committed to Ukraine w/out victory

- US/Europe financial support and Ukraine army operational know how are both increasing

- Rather than fracturing NATO, Russia has energized it – Finland, Sweden now approved to join

- This news, if comes to pass, would be embraced by the market as relief from human casualties of war

- Oil and natural gas likely stay elevated – hard to see Europe returning to Russia as supplier

- Agribusiness has been impacted as Russia/Ukraine corridor a major “breadbasket”, one of largest exporters of wheat and meslin

- Fertilizer prices spiked but now falling and likely continue to as Russian shipments accelerated

- Metals prices – iron and steel products, platinum, nickel, pig iron – likely decline with new shipments

- Shipping routes normalize over time – more wheat from Ukraine, less coal needed from India

- General inflation from food, energy, supply chain disruption could be eased, aiding the Fed

- We were skeptical of Russian action back in February, we were wrong…a retrenchment of hostilities is a good thought exercise to work through, regardless of timing

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments