The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

Stagflation argument takes a bit of a hit last week…CPI and PPI data are tame..finally.

- Stock market rally aided by CPI and PPI data prints…perhaps peak inflation has arrived…

- Week prior employment report doused the flames of recession talk…

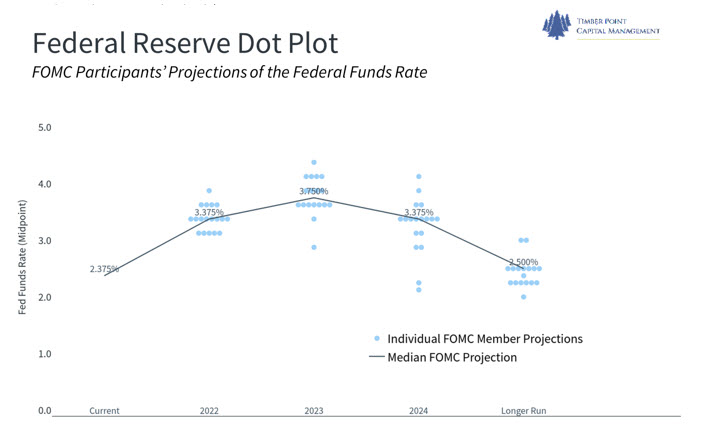

- Above data points were “good” news but we don’t see a Fed “pivot” to slower rate increases

- Still expect 50-75bps at the September meeting as Fed targets 3.25% – 3.50% exit rate from ‘22

- Be mindful about components of CPI…gasoline is 5% while food and shelter are 11% and 32%

- The price of gasoline declined 11% in July since hitting $5 in June…how much lower can it go?

- Food prices posted 7th consecutive monthly increase of greater than .9%…increases broad based

- Shelter, or owner equivalent rent, was up 5% y/y…this understates rental rate increases

- Redfin rental increases in the low teens % range implies shelter impact could grow in CPI figure

- Further, August and September 2021 were “tame” inflation months with .25% m/m increases

- Inflation still running 8%, talk of return to 2-3% in near term are over-optimistic

- Bond market sold the news of inflation print, rally had gone too far and more wood to chop

- It will take many months of “zero inflation” to move CPI meaningfully lower

- Bottom line: Fed unlikely to bring inflation down to 5% by year end…Fed continues to hike

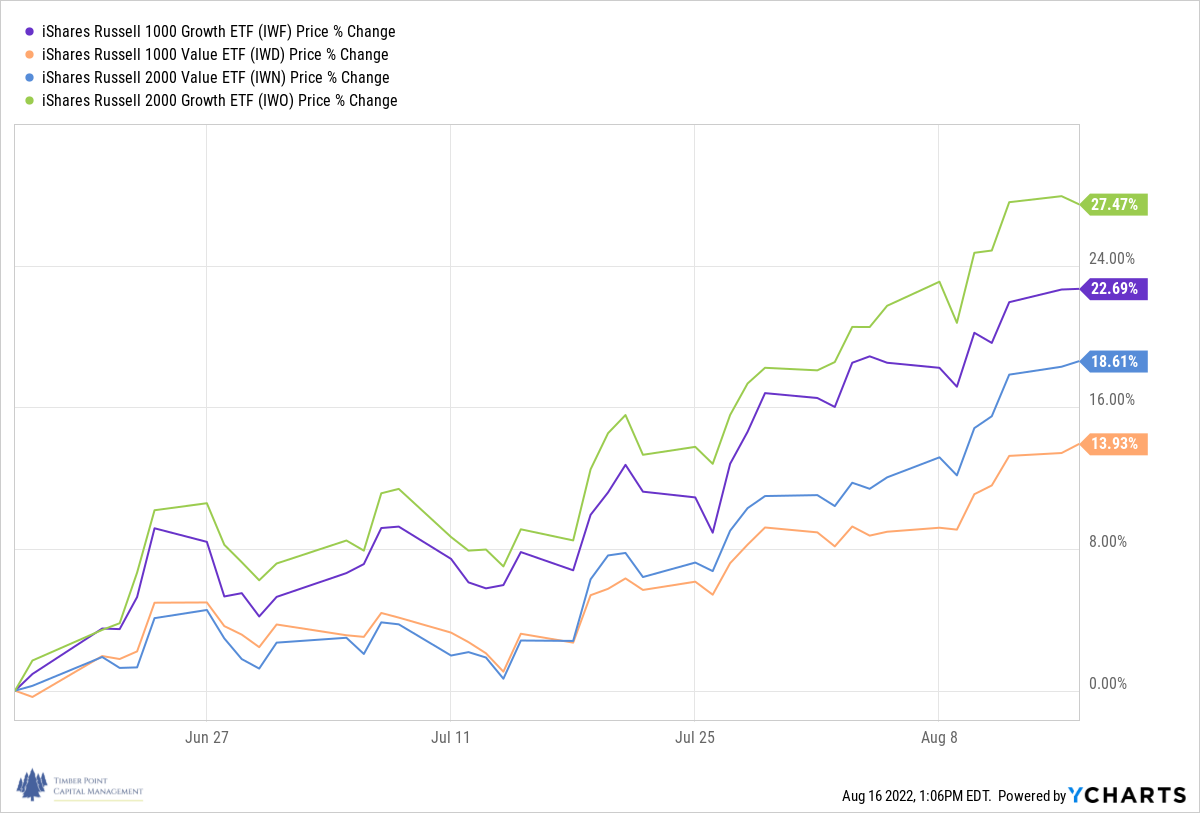

The new “bull” market rides on…size and style matters

- The S&P 500 and Russell 2000 continue to rally in August, have now gained 17%/21% from mid-June lows

- To put this in context…post Y2K there were three SPX rallies of > 15% between 2000 and 2003

- Between late 2007 peak and 2009 bottom, there were 6 SPX rallies, 5 in the single digit range

- Big differences between the two periods and today…Fed was in easing mode…and the Fed’s balance sheet was a fraction of its current size

- Russell 1K Growth (up 22.5%) has outperformed Russell 1K Value by 900 bp’s since mid-June

- Russell 2K Growth (up 27.5%) outperforming Russell 2K Value by 800 bp’s since mid-June lows

- We have liked small caps based on valuation and extreme negative sentiment – we still do but have pared back some of our bet

- Energy names are still attractive given US and global dynamics impacting supply as well as strong capital efficiency practiced by management teams

- Sentiment and investor positioning are still negative…there is cash on the sideline and hedging that still needs to be unwound…watching consumer and economic news closely

Fixed Income markets rebound but there has been no place to hide in 2022…

- All segments of the FI market have been difficult in ’22…YTD, the Barclays Agg is down 8.7%

- Inflation protected securities have modestly outperformed on a YTD basis yet remain down on the year. TIP’s are bonds first, inflation protection second

- Volatility is the new normal as yield curve steepens again and USD rolls over…inflation expectations in flux

- High yield spreads narrowed by 100bps QTD as recessionary fears diminished

- Emerging markets debt is worst performer – no surprise given the strong USD

- Pandemic programs have helped extend the credit cycle – we believe it still exists, however

- Credit fundamentals are solid today though banks did build reserves during the quarter

- We believe credit risk is not resident in bank balance sheets but on off-balance sheet entities

- Private equity, BDC’s (business development companies), hedge funds and other “shadow” bankers have fueled the economy with covenant light loans

- That said, we still think the economy is healthy enough to avoid a major stress situation

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments