The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

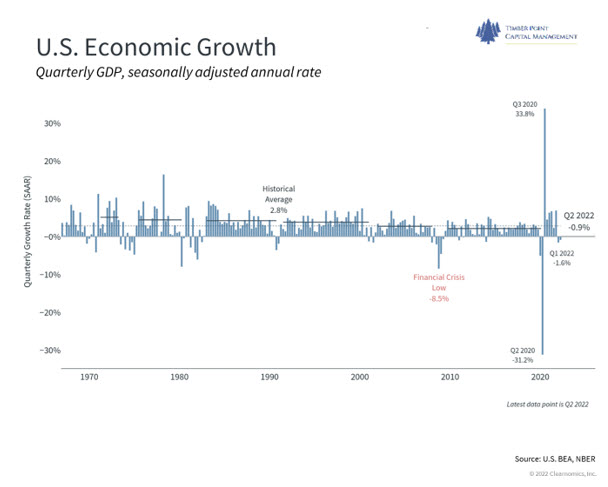

When is a recession not a recession? When the administration deems it so…

- Two quarters of negative GDP no longer applies…deny and move on by…

- NBER recession call requires depth, diffusion, and duration – in varying degrees

- NBER identified peak (12/07) and trough (6/09) of Great Fin’l Crisis ~ 1 year later

- Biden continues to point to the strength of consumer and unemployment rate…

- Friday’s employment report posted 528,000 new jobs; well ahead of estimates

- Yet forward indicators on the employment report show potential challenges…

- JOLTS data showing decline in job openings, largest since pre-pandemic days

- Initial Unemployment Claims edged up to 7-month high, though still at low levels

- Corporate announcements of hiring delays or firings seems to be picking up

Source: Bloomberg, Bureau of Labor Statistics

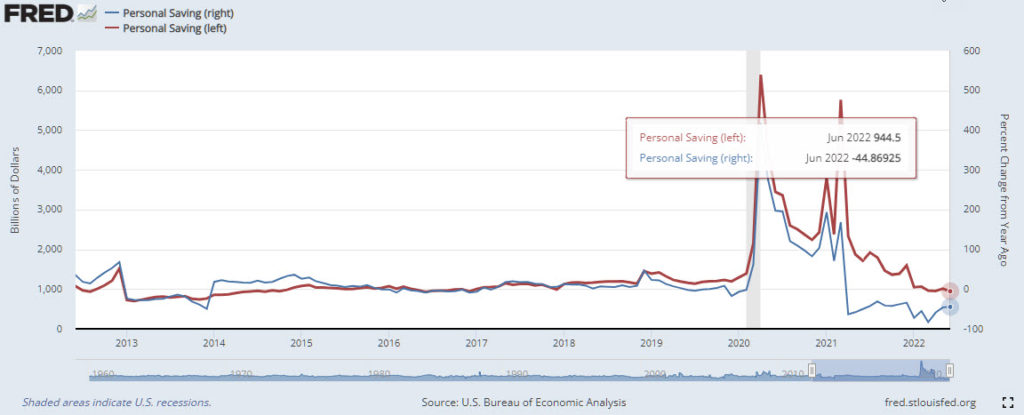

- Personal savings ($944B) are now below pre-pandemic levels and back to average for past 10 years

- But unlike much of the past decade, this time the consumer is feeling much higher prices for food, gas, and other items…

- If the labor market has peaked, the consumer may not remain as strong as many hope…

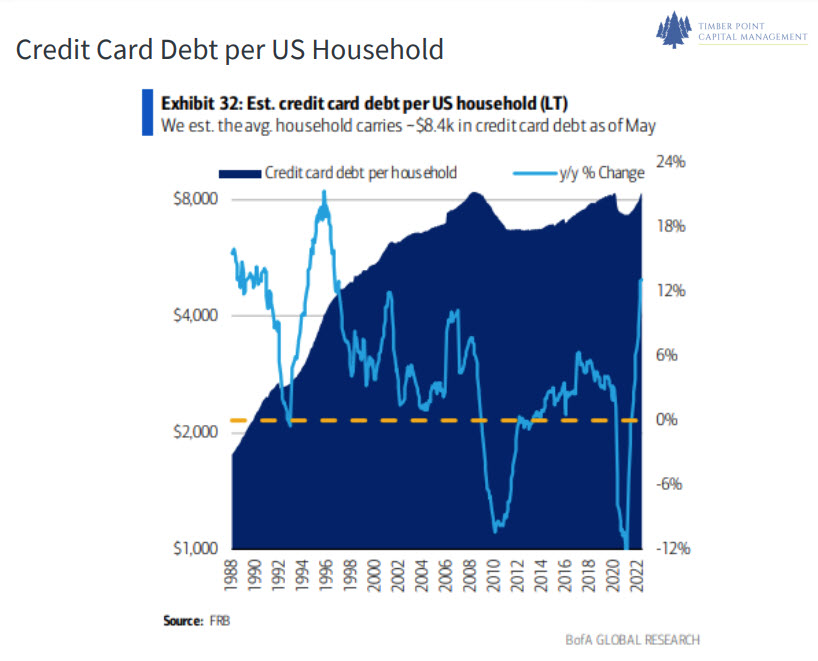

- Which may be the reason why absolute levels of credit card debt are growing

- While delinquencies are still low this bears watching

- The consumer was described as “healthy” in many of the bank’s earnings reports

- Powell, the Biden administration and TPCM are focused on the ongoing strength of the consumer

Inflation Reduction Act – fanciful marketing, believe it at your own peril…

- Interesting name for a bill that front loads spending and will be deficit financed

- CBO estimates negligible inflation impact in ‘22/’23; has not evaluated later years

- Revenues are a function of minimum 15% tax…tax accountants will be busy as corporations wriggle free from its grasp

- Subsidy giveaways expanded/extended to the renewable industry – long renewables?

- Corporate loopholes to be closed – oh, but not carried interest…imagine that!

- Get ready for more IRS agents knocking on your and corporation’s doors!

- Medicare pricing controls on 12 drugs…a first step in government price controls?

- Nor is there meaningful fiscal deficit reform despite Manchin’s statements

- 2/3 of deficit reduction ($200B) will come from less “tax avoidance”

- Democrat’s desperately need legislation to point to for mid-term elections

- Republicans appear to be losing their grip on the Senate…watch closely…

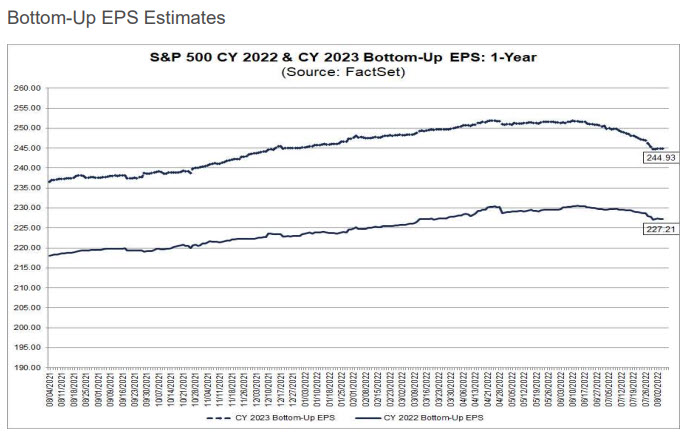

Earnings estimates revisions…Q222 revisions no worse than historical norms

- Along with jobs, earnings estimate revisions are a piece of good news

- Anticipated negative eps revisions recession environment not materializing…yet

- Earnings season thus far has been fairly NORMAL with respect to eps revisions

- 87% of SPX 500 companies have reported, 75% with eps above mean estimate

- This compares to 5-year average of 77%…

- EPS positive surprises show largest price increase since Q3 2019 (2.1%)

- Market response to eps negative surprise is (0.0%)…speaks to poor sentiment

- Q1 2009 was last time negative eps surprises did not drive negative price action

- Ex Energy, SPX 500 reporting a 4% decline in Q222 eps

- 2023 estimates…have declined from ~ $250 to $244…only a 2% decrease, not significant yet and certainly not in context of past recessions earnings revisions

- Implies that SPX 500 trading at 17x…certainly supported by lower yields since mid-June

Source: Factset

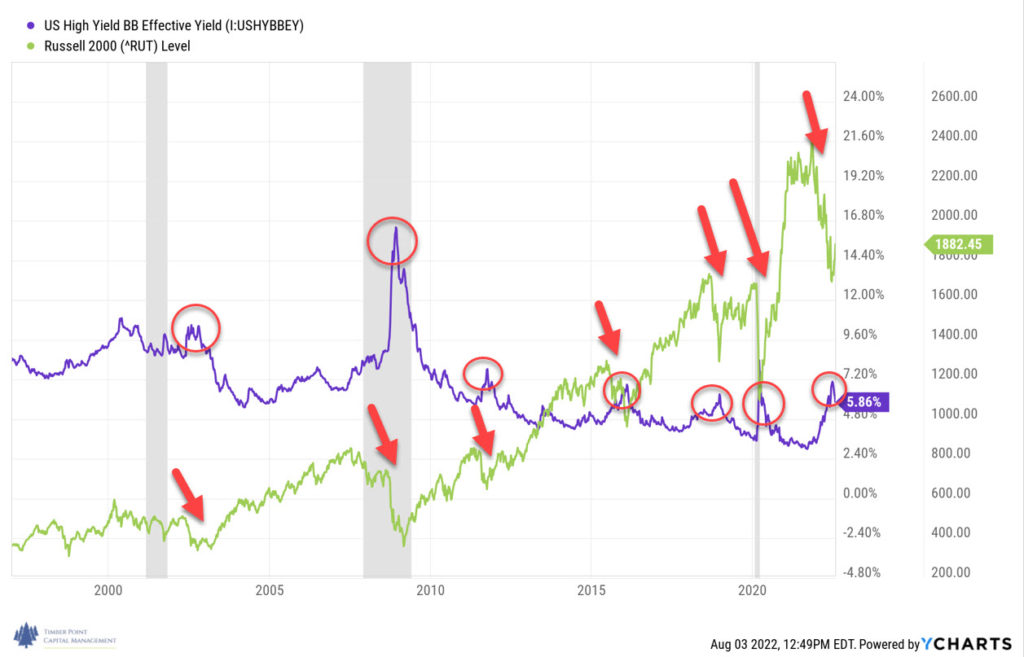

Small caps continue their outperformance in month of July…

- High yield contraction (BB) moves money to riskier elements in market

- Long term chart above shows small caps bottom with peaks in yields (red circles)

- We had pointed out that valuation and sentiment on small caps were at extremes

- Dovish Powell comments at recent Fed meeting add fuel to the rally

- RUT and IWC (micro-cap) have rebounded, now above rising 50 dma, closing in on 200 dma (level to watch is RUT @ 2,048)

- Small caps are still cheap, are just now getting into the “meat” of eps season

- We continue to position in small caps, though have trimmed a bit in recent rally

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments