The Timber Log is a quick overview of Timber Point Capital’s most recent investment thoughts. If you have questions about the content, please reach out to Patrick Mullin. The information contained herein does not constitute investment advice or a recommendation for you to purchase or sell any specific security.

- September not starting on a happy note as all asset classes continue to fall on the back of Fed Chairman Powell’s comments at Jackson Hole.

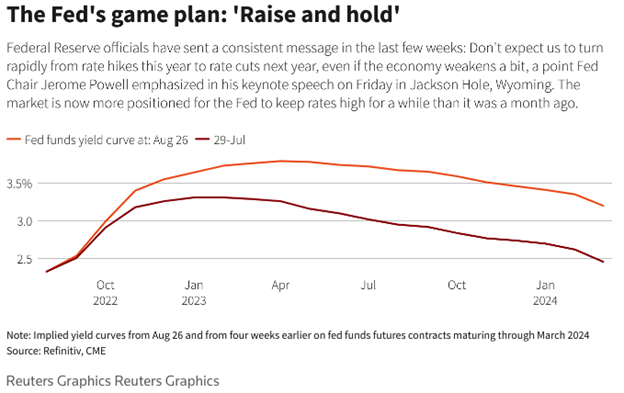

- Powell’s speech was half the length of last year’s at only 8 minutes because there truly was very little new to say…it was rumored that Powell did not want to make a speech, at all.

- The Fed remains committed to quelling inflation. Fed would rather have a temporary economic slowdown than a structural inflation problem.

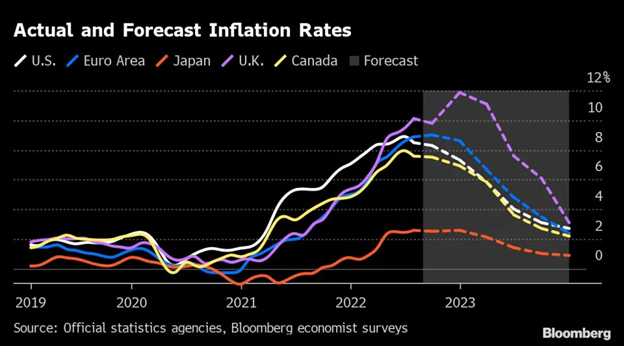

- YET forward indications are that inflation IS slowing down.

- Money supply has peaked; Commodity prices are falling; Supply chains are opening up – all point to falling inflation on a going forward basis.

- YET, it will take several months for headline inflation rates to get near the Fed’s target of 2%.

- Fed pivot is currently off the table and expectations are for a 75bps tightening in September.

- So, it appears that we will get through the inflation problem but will the pending economic slowdown continue to negatively impact markets?

- Since Powell’s speech ALL major asset classes have fallen sharply.

- No surprise that risk on assets such as stocks and high yield sold off but so have risk off assets such as US Treasuries and gold.

- Despite the grim macro-economic environment, we have continued to emphasize small cap equities as a source of potential value and excess return.

- The quip on small caps is that they lead markets into a recession and lead markets out of a recession.

- During June of this year, on a valuation basis, the S&P 600 traded back to its COVID lows of roughly 11x forward earnings. Possibly, small caps have already discounted the slowdown….

- Subsequently, small caps have outperformed this quarter with the Russell 2000 index up 8% versus the S&P 600 up 6% for the quarter.

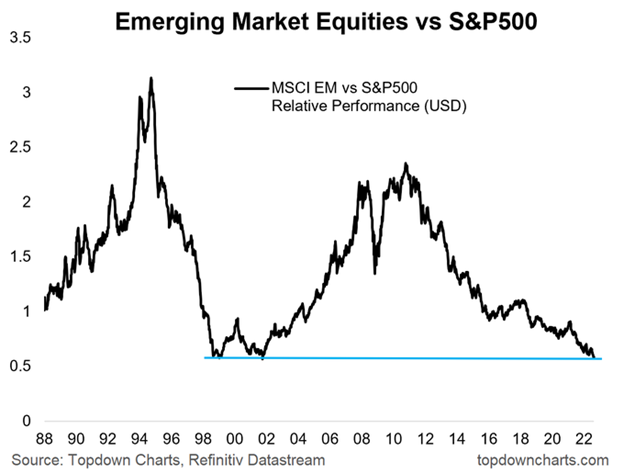

- The dollar remains the king currency reflecting among other things the sad state of affairs for international economies and markets.

- European growth expectations have fallen sharply amid a broken, hopeless energy system.

- Japan remains demographically challenged and economically stagnated.

- China continues to struggle from COVID shutdowns, slowing economic growth and a growing real estate and banking problem.

- EM as an asset class has lagged for over 10 years and now trades at nearly a 40% valuation discount to US equities.

What is our bottom line:

- Is there a potential for a market reversal?

- Yes, extreme valuation differentials create opportunities.

- YET, the dollar likely needs to peak for this opportunity to be realized.

- AND, the dollar is not likely to peak until the Fed takes it’s foot off the accelerator.

- AND, the Fed won’t do that until a meaningful improvement in inflation is realized.

- It all boils down to watching for signs that inflation is on a glide path lower.

IMPORTANT DISCLOSURES The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s’ opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments