Markets contended with a trifecta of economic and geo-political worries this past quarter which created a very challenging environment for investors. A continued spike in inflation, a meaningful change in Federal Reserve policy and an outright war in Europe all had a negative impact on investor sentiment and returns. Somewhat amazingly, Covid-19 fell from the headlines as people quickly focused on new sources of concern, particularly the conflict in Ukraine.

When looking at this past quarter’s returns, a correction in the equity market should not have been a great surprise. Frankly, it was long overdue but thus far has proved to not be meaningfully significant. At the “peak worry” point in late February, the US equity market was down nearly 13% but ultimately finished down less than 5% for the quarter. For perspective, this was after a 27% return in 2021, where we only experienced one 5% correction. But while the S&P 500 posted a modest correction, individual sectors and securities experienced high levels of volatility. Technology in general and select FAANG stocks, such as Meta (FB) and Netflix (NFLX), which have been darlings for investors over the past ten years, posted meaningful declines. On the flip side, energy companies, generally under owned by institutional investors, proved to be the new go-to investment of choice, rising nearly 40% over the period. Utilities also posted positive returns, despite the higher yield environment, as safety investments become paramount. It appears as if the rotation which began over a year ago, remains fully intact.

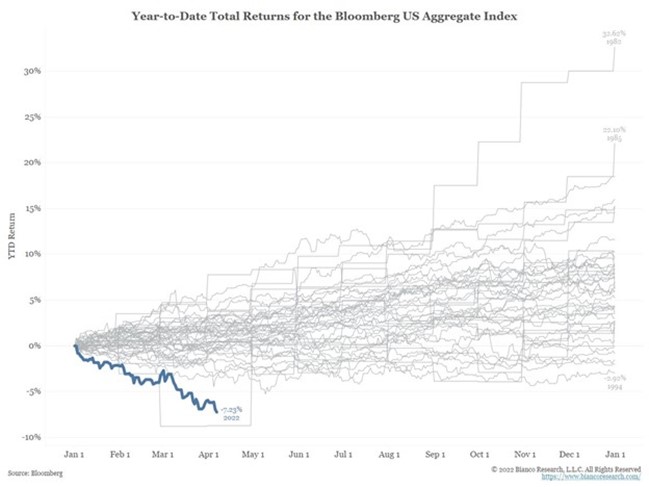

Yet it was the bond market where negative returns proved to be outsized relative to history. The industry benchmark, the Bloomberg Aggregate Bond Index, was down nearly 6% for the quarter and as of this writing is down over 7% for the year. If the year were to end now, the index would post its worst annual return since its inception….and we are only one quarter of the way through 2022! A low base of interest rates owing to Covid-19 measures, a dramatic pickup in inflation and a newly tightening Fed have all led to this bond market rout.

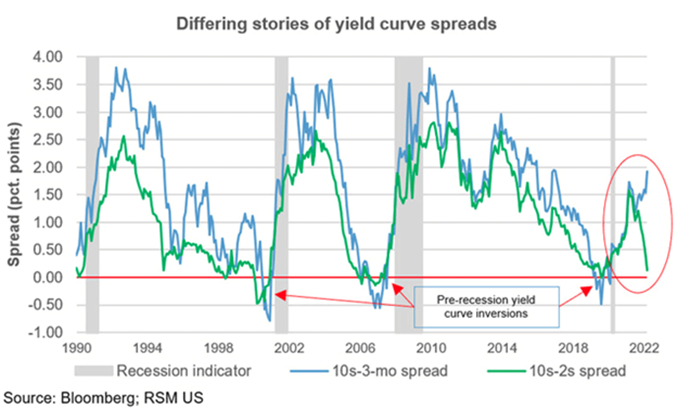

Interest rates have moved sharply higher on shorter maturity bonds as the market discounts the future tightenings by the Federal Reserve. This flattening of the yield curve has proved to be another worry for investors as inverted yield curves have historically been precursors to recessions; further spooking equity markets. There is a debate among economists on which yield curve should be used. The most quoted spread and the curve which is currently nearest to being inverted is the US Treasury 2-10’s spread. The 3-month bill to 10- year note spread remains positively sloped. Yet as the Fed appears to be moving towards a more aggressive tightening path, this spread too shall tighten and possibly flatten or invert.

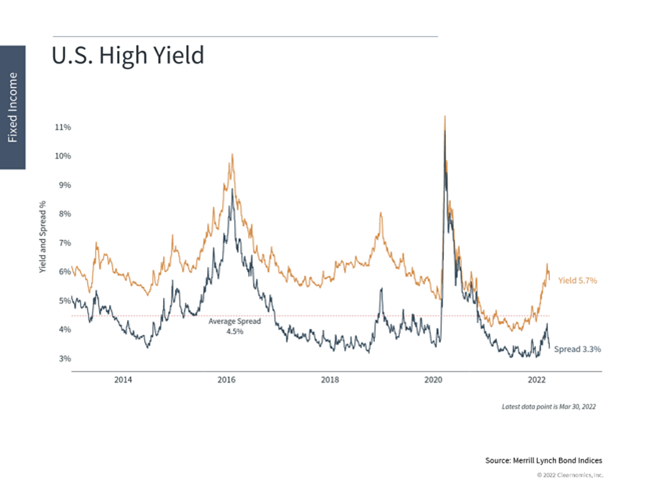

Regardless of your curve preference, the key factor to worry about during Fed tightening cycles is the correlated impact on private lending and credit creation. By themselves, inverted yield curves do not cause recessions, meaningful restrictions on private credit creation do. And at this point, we do not believe that credit markets are yet pointing towards a panic or credit crunch. As with all fixed income investments, the current yield on high yield bonds have moved higher this year yet the spread over Treasuries has remained tight and in fact has recently moved tighter. These levels of credit spreads do not lead us to believe that a credit crunch is imminent. By most estimations banks have not become overextended during this most recent cycle and private lending markets remain solid. Credit is always a factor to monitor but at this point we don’t see meaningful levels of risk or stress.

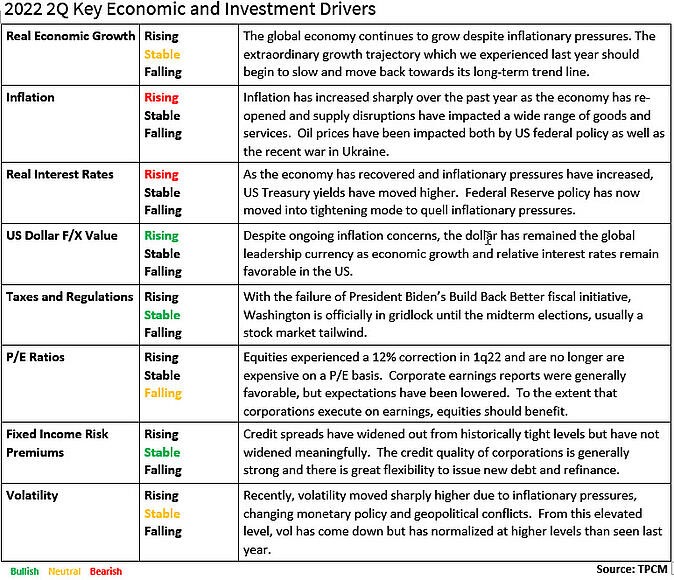

Entering the second quarter, beyond rates and credit, we continue to evaluate a wide range of economic and market variables which serve as the basis for our investment outlook and allocations.

Handicapping the multitude of fundamental variables, we believe three stand out as important risk points which merit close attention: inflation, the path and speed of interest rate changes and the associated impact on economic growth. Of the three, inflation appears to be the key factor which will drive policy, politics and markets going forward. To the extent that inflation moderates either through a normal supply/demand response or through a monetary policy response, markets should respond favorably. We already are seeing signs of some commodity prices, notably oil, falling from recent highs. If, however, inflationary trends do not diminish, global central bankers will likely follow the Fed’s lead and a global tightening regime will ensue, likely impacting economic growth and markets.

All things considered, we continue to believe that the global economy remains on a growth trajectory, particularly as Covid-19 restrictions (with the exception of China) continue to abate. As indicated above, we further believe that the economy will slow from a very rapid growth pace achieved from Covid-19 lows, but do not yet believe that a recession is imminent despite the Fed moving to tighten monetary policy and the flat yield curve.

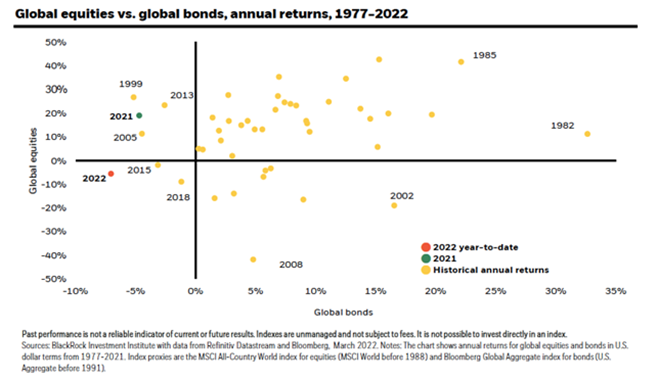

To date however, the combined effect of higher inflation and rates and the potential for a slowing economy have abruptly impacted investors as both equity and bond returns have posted negative returns thus far in 2022.

This is an unusual phenomenon. The negative correlation and diversification benefits which investors typically experience in a stock/bond portfolio have not been present as both asset classes have repriced lower. The low base effects of interest rates have provided no yield cushion to absorb the negative price volatility in bonds. Last year’s slow glide higher in rates is now accelerating, putting negative price pressure on bonds rendering them useless from an equity market diversification standpoint.

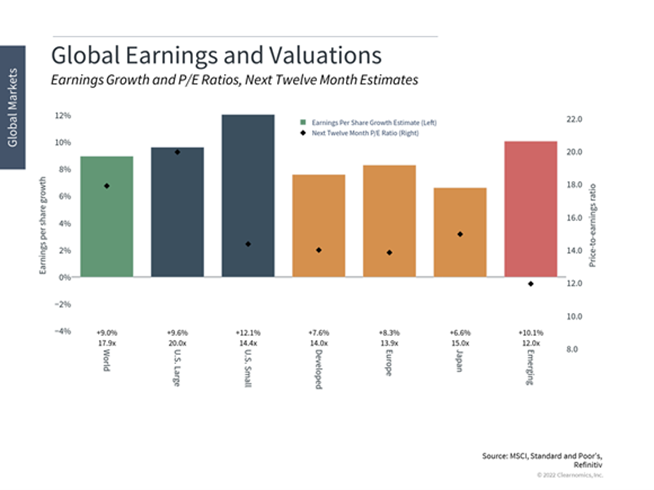

In as much as the pace of the bond market selloff may diminish, the Fed’s recent policy announcements virtually assure a higher rate structure across the yield curve, making bonds an unattractive investment. Conversely, we do believe that equities, particularly US equities, are relatively attractive, as our base case is that the economy and earnings will continue to grow. Broad market equity valuations have declined and are no longer considered excessive which should give investors comfort.

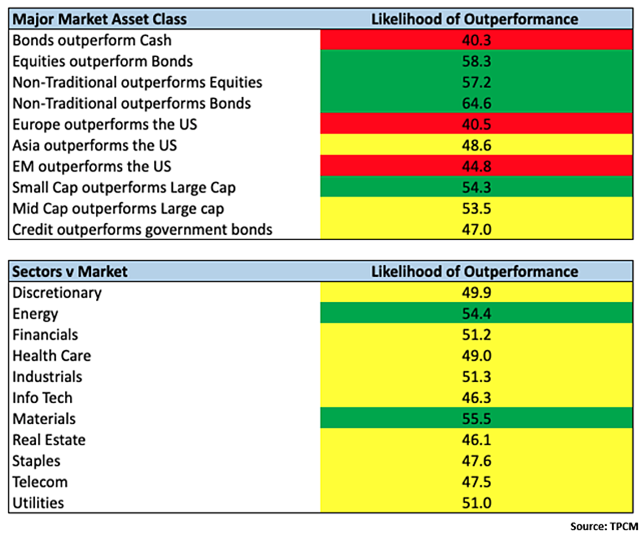

International markets and small cap equities remain cheap relative to US large cap stocks. Despite their underperformance, we continue to favor smaller cap stocks due to earnings growth potential and valuation. We remain underweight international markets as we anticipate further dollar strength. From a sector standpoint, US equity market leadership may be different than previous cycles as value oriented and other commodity oriented sectors continue to outperform. As has been widely reported, large cap growth’s sensitivity to interest rates have been a headwind and may continue to be so throughout this year.

Although we do believe that the prospects for equities will continue to improve from the first quarter’s correction, markets will likely remain challenging, and pockets of volatility will emerge. Correspondingly, as fixed income’s benefits as a diversification tool have diminished, we are overweighting non-traditional alternatives as a dynamic tool to hedge market risks and take advantage of opportunities as they develop.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments