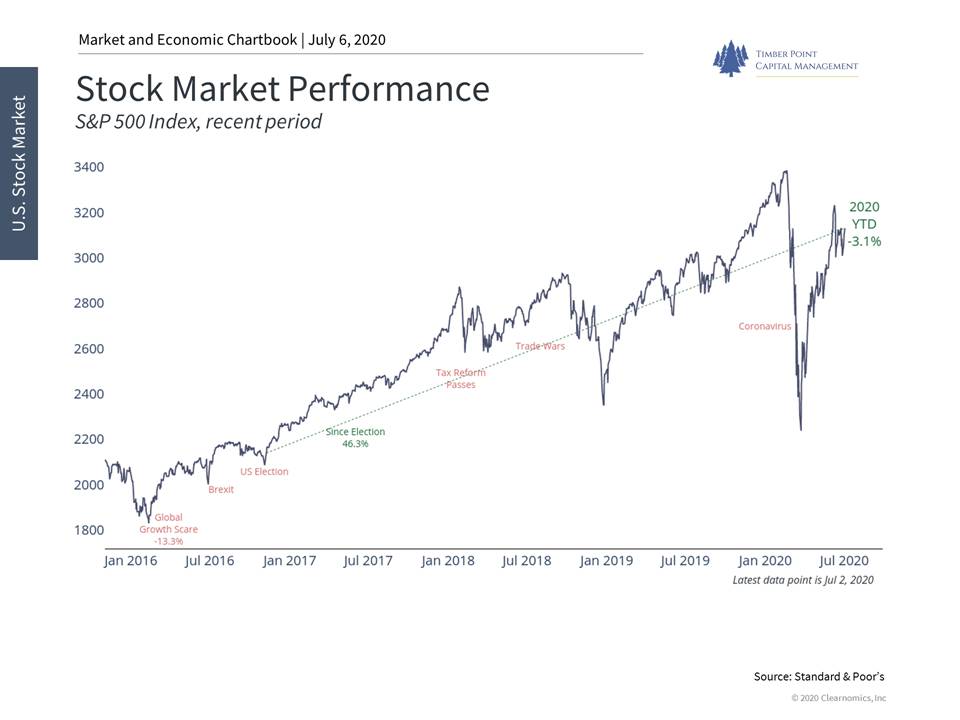

Since March, the US stock market has enjoyed a 20% bounce from its bottom seemingly on the vague promise that the US economy was going to re-open and life would resume somewhat normally. To a subset of investors, the notion of recovery has seemed preposterous as the economic damage inflicted by COVID-19 has been so large, so unprecedented and to a great extent not fully digested by the overall economy today. A second COVID wave, unemployment, commercial real estate, municipal finances, consumer spending, et al, are at the top of their very long worry list.

Yet another subset of investors has found reason to rejoice as the opportunities afforded them during the market meltdown seemed too good to pass up. In another instance of populists versus legacy powers, Robinhooders and other seemingly inexperienced retail investors have flocked to the stock market to take advantage of the recent surge in equities while many institutional investors preached caution. In a somewhat infamous twitter rant (warning explicit language), David Portnoy, the founder of Barstool Sports, turned day trader took a swing at the vested powers of the institutional investment community, particularly Howard Marks and Oaktree Capital. More so than many other endeavors, the investment business is built on the premise that talk is cheap, and your returns define you. If that truly is the case, I would mark the 2Q scorecard Portnoy-1, Marks-O.

At Timber Point Capital Management, we too have enjoyed the recent market recovery. In our outlook piece from last quarter, we expressed modest optimism that both life and the market would improve as the COVID crisis diminished. We preached perseverance and an active approach to finding opportunities among the carnage. I would like to say that we were all in on equities and other risk assets but that is not entirely true. We did however find many interesting and very profitable investments in our basket of recovery stocks (more on that in a subsequent blog post). Franchise US companies, trading down 50% or more from previous highs with strong balance sheets and financial flexibility were too good to pass up, despite a multitude of meaningful macro worry points and risk factors. Investments in these companies and a general bias towards other cyclical investments drove our portfolio’s returns, over the period.

On a going forward basis, we remain (I hate this term➡) cautiously optimistic. When evaluating our key economic and investment drivers there are both signs of a v-shaped recovery and continued risk variables and headwinds.

2020 3Q Key Economic and Investment Drivers

| Real Economic Growth | Rising

Stable Falling |

The shock of COVID-19 and the subsequent shutdown have been devastating to the US economy. As normalization occurs the economy should recover sharply from today’s depressed levels. Dramatic fiscal and monetary stimulus should provide meaningful help, but secondary effects of the shutdown will have an impact. |

| Inflation | Rising

Stable Falling |

Given the collapse of demand across the economic spectrum, inflationary pressures have remained muted. Supply disruptions may occur across pockets of the economy as “opening for business” will not be an instantaneous process. |

| Real Interest Rates | Rising

Stable Falling |

The Federal Reserve has been proactive in dealing with COVID-19 by initiating a wide range of stimulus measures, including a resumption of quantitative easing. Longer term interest rates remain low but are now reflecting an improved growth outlook. |

| US Dollar F/X Value | Rising

Stable Falling |

The dollar has fallen sharply from highs as the interest rate differentials between US rates and international rates have narrowed sharply. The US bond market is not as nearly as attractive a resting spot for global capital. |

| Taxes and Regulations | Rising

Stable Falling |

The fiscal response to COVID-19 has been meaningful with over $2 trillion of aid being injected in the economy and possibly more on the way. As a result of COVID-19, government intervention in the economy has been significant and rising. The pending election will clearly impact future policy direction. |

| P/E Ratios | Rising

Stable Falling |

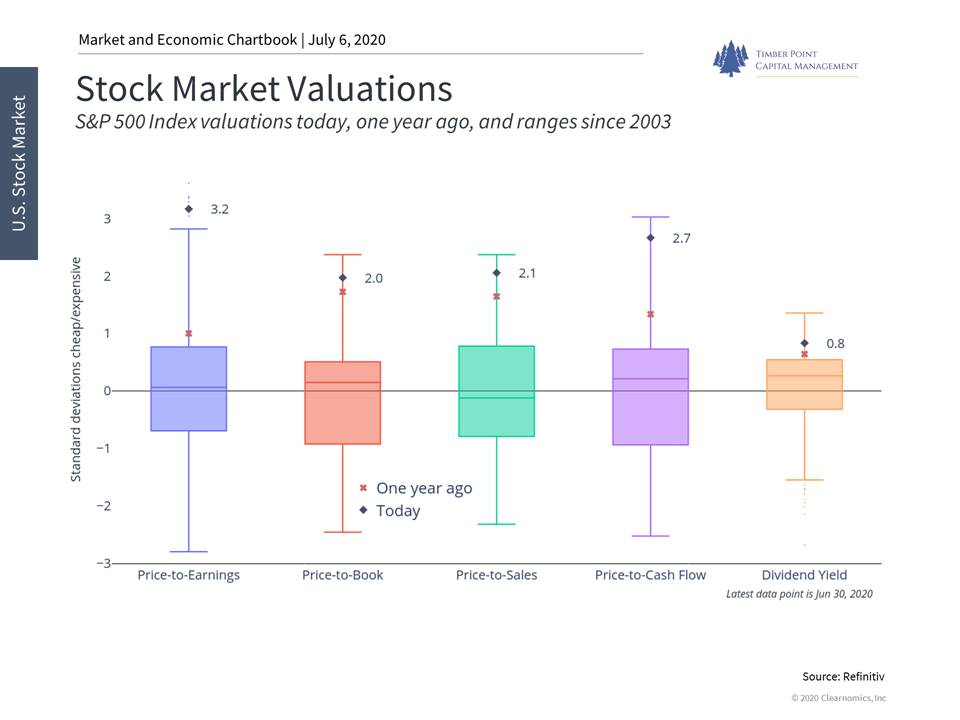

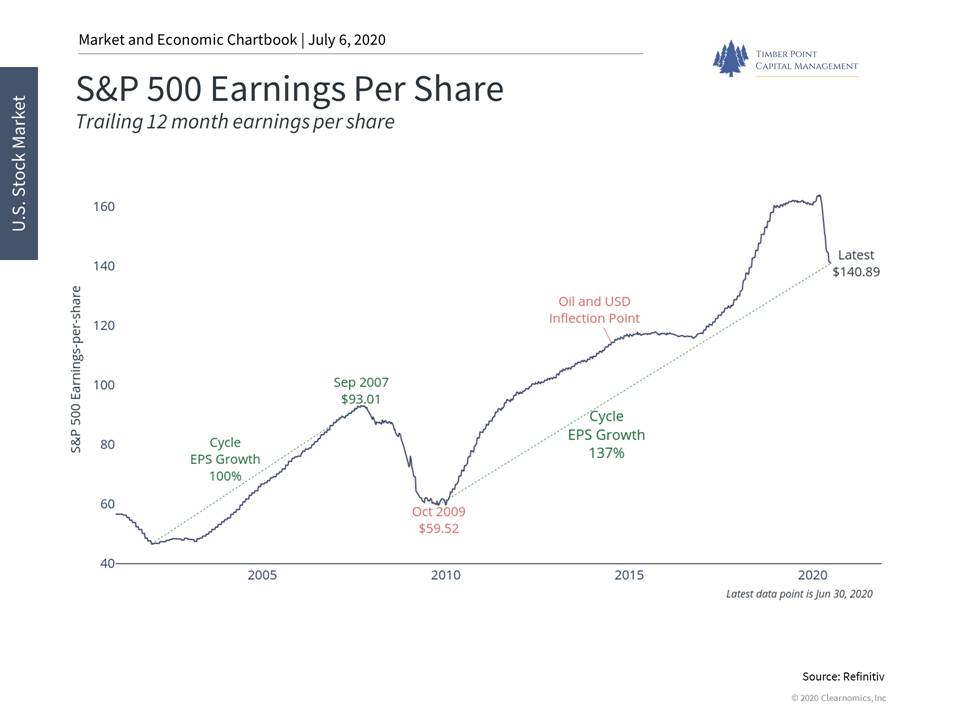

As with the broader economy, earnings have troughed and are now showing signs of improvement. It is unlikely that S&P 500 earnings get back to their 2019 peak, however. Valuation metrics remain high. |

| Fixed Income Risk Premiums | Rising

Stable Falling |

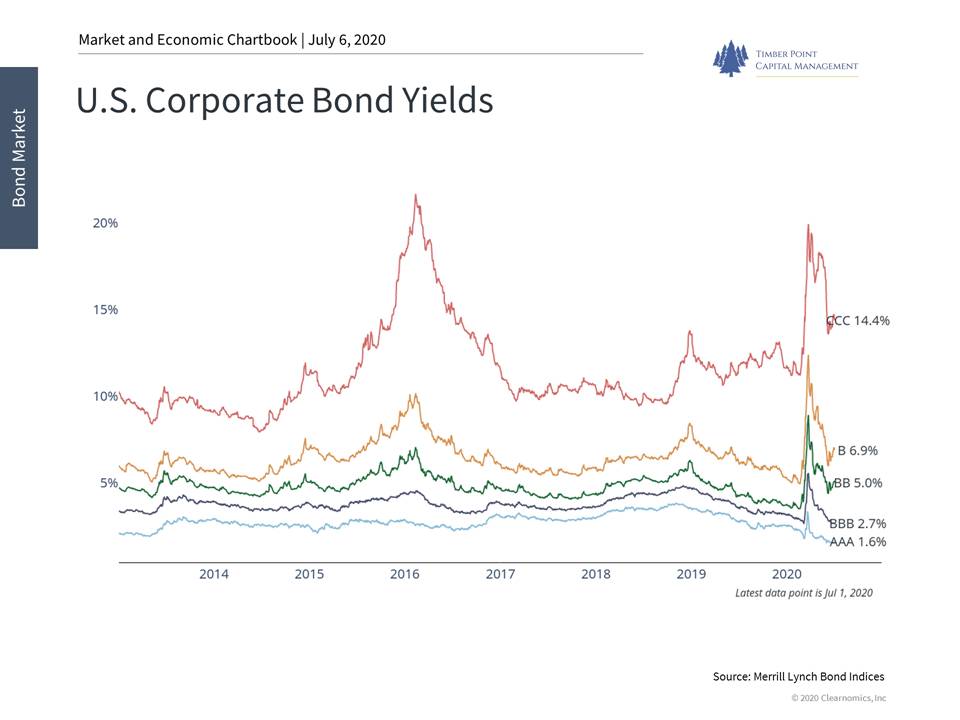

Supported by Fed policy, broad credit spreads have fallen sharply upon the re-opening of the economy. Security specific risks will remain across credit investments as defaults will be inevitable among weak players in stressed industries. |

| Volatility | Rising

Stable Falling |

Volatility which spiked to near record levels at the depths of the COVID crisis, has fallen as the crisis has subsided and the economy has improved. Pockets of increased volatility are likely, particularly going into the election. |

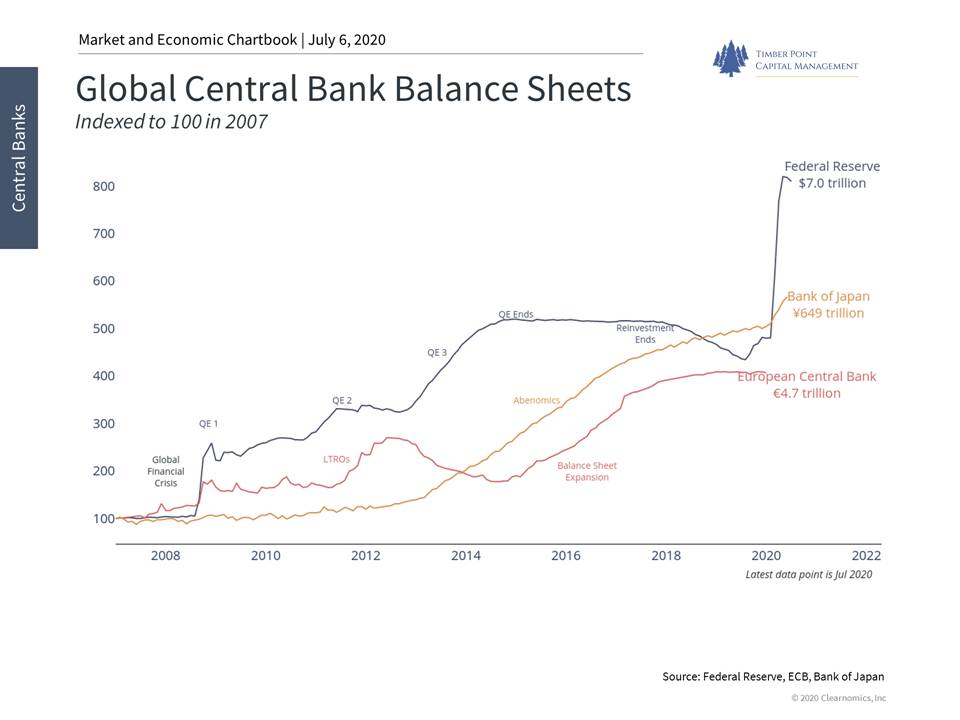

The monetary policy response to COVID is among our most optimistic variables and should continue to be highly supportive of risk assets over the near term. For the umpteenth time over the past dozen years, central banks have come to the rescue of investors. In this instance the Federal Reserve has expanded its balance sheet to $7 trillion and added the capacity to purchase not just government backed securities, but for the first time both high grade and high yield corporate bonds. In our viewpoint, this creates a meaningful floor to risk assets as the Fed truly is the buyer of last resort of corporate debt. In turn, this opens the high yield issuance market and allows companies to refinance and shore up balance sheets. This has been crucially important to supporting markets.

As indicated, this flush of cash provided to the markets by the Federal Reserve has reduced near term financial market risk which has been a boon for asset class returns, most notably high yield corporate bonds and by extension US equities.

When looking objectively at equity market opportunities today, however, one most definitely needs to be mindful of valuations. We do not often let valuations be the exclusive variable in which we make investment decisions. Furthermore, we do believe that the marketplace is mostly efficient, and the markets reflect a view on the future, not the past. Yet at extremes, one needs to pay attention and today’s equity market valuations are extreme. Bears will look at these valuation metrics and presume that any equity investment made today is being purchased at too high of a price. Bulls will concede that prices may be high but that the marketplace is discounting a v-shaped recovery in earnings not dissimilar to the v-shaped recovery we are seeing in employment and several other key economic variables.

Today, our opinion on earnings and valuation is a show-me viewpoint. We recognize the extremes in valuations but also see a scenario where companies can grow into these valuations. S&P 500 earnings have cratered due to the COVID economic shutdown, but it is possible that expectations are now too low. To the extent that the monetary and fiscal stimulus continue to provide support and stimulus to the real economy, earnings expectations could increase sharply over the next few months justifying today’s lofty stock market valuations.

Among equities we have seen a modest rotation among sectors as energy and consumer discretionary stocks have bounced from lows. Technology, however, remains the leadership asset class which makes intuitive sense as we think through what the economy will look like post COVID. Technological solutions have been crucially important in the growing work at home movement and will likely continue to lead the market higher as technological innovation will increasingly be required in a re-engineered workplace environment. By extension, other sectors such as commercial real estate will be challenged in this new post COVID economy as workplaces evolve from centralized urban campuses to smaller, decentralized work environments.

All of this continues to argue for an active approach to investing. Over the past several years, passive approaches to investing have seen an increase in popularity and efficacy. Owning the S&P 500 has been an extremely cost-efficient approach to investing. Yet, on a going forward basis we continue to believe that a more active approach is going to be needed across asset classes, countries, sectors and securities. The COVID crisis is forcing significant change across the economic landscape. Companies which can dynamically alter their operating framework to adjust to this new environment will be industry leaders and likely stock market outperformers. Companies that do not aggressively alter their business models will underperform. Investment decision makers will be required to understand these rapidly changing dynamics and alter portfolios appropriately.

Overall, for the third quarter we continue to favor risk assets over defensive assets with our viewpoint being driven primarily to today’s monetary policy stance. We remain overweight equities broadly, and particularly smaller capitalization stocks. We continue to overweight domestic equities over international stocks as the opportunities outside the United States seem somewhat unspectacular and typically opaque. China is experiencing its own post COVID v-shaped recovery but not so much for the rest of the world. Given our expectations for dynamic change and expanding of economic winners and losers, we continue to emphasize weightings in alternative investments. The flexible, opportunistic nature of non-traditional, alternative strategies should be beneficial in this volatile investment environment.

We are very aware of the risks ahead of us, including a very uncertain political environment and presidential election in just a few short months. Our somewhat optimistic viewpoint may require a future alteration if some of the more worrisome variables surrounding COVID and the re-opening of the economy become paramount again. In the meantime, we are prescribing to theme of “Don’t Fight the Fed”. Economic execution will be required at both the macro and micro levels but the extraordinary size and scope of the Fed’s response to this crisis is the differentiator and should support investment markets in the near future.

David Cleary, CFA is the President and Chief Investment Officer at Timber Point Capital Management, LLC. Prior to founding TPCM, David served as the Chief Investment Officer at Crow Point Partners. Before Crow Point, Mr. Cleary spent 23 years at Lazard Asset Management where he held a series of senior portfolio management roles over multi-asset and global fixed income strategies. Additionally, he served as the firm’s global head of fixed income, a $26 billion platform. Prior to Lazard, David worked at UBS and IBJ Schroder, mostly in fixed income asset management roles. He began working in the asset management field in 1987 upon his graduation from Cornell University, with a BS in Business Management and Applied Economics. Mr. Cleary holds a Chartered Financial Analyst (CFA) designation.

IMPORTANT DISCLOSURES

The information in this report was prepared by Timber Point Capital Management, LLC. Opinions represent TPCM’s and IPI’s opinion as of the date of this report and are for general information purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. IPI does not undertake to advise you of any change in its opinions or the information contained in this report. The information contained herein constitutes general information and is not directed to, designed for, or individually tailored to, any particular investor or potential investor.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon.

This communication is provided for informational purposes only and is not an offer, recommendation, or solicitation to buy or sell any security or other investment. This communication does not constitute, nor should it be regarded as, investment research or a research report, a securities or investment recommendation, nor does it provide information reasonably sufficient upon which to base an investment decision. Additional analysis of your or your client’s specific parameters would be required to make an investment decision. This communication is not based on the investment objectives, strategies, goals, financial circumstances, needs or risk tolerance of any client or portfolio and is not presented as suitable to any other particular client or portfolio. Securities and investment advice offered through Investment Planners, Inc. (Member FINRA/SIPC) and IPI Wealth Management, Inc., 226 W. Eldorado Street, Decatur, IL 62522. 217-425-6340.

Recent Comments